Bankruptcy Law: A Financial Recuperation Tool

The corpus of federal statutes and case law that controls bankruptcy cases is known as bankruptcy law. It deals with a variety of disagreements that come up in financial and economic dealings.

Debtors are eligible to apply for property exemptions, which let them preserve personal belongings, business equipment, and even residences up to a specific amount of value. Any nonexempt property must also be liquidated in order to pay off unsecured creditors.

Arrangement

A judge and a trustee designated by the court are involved in the intricate legal procedure of bankruptcy. You need to gather financial data, such as assets, income, and obligations, before filing. This provides a clear picture of your circumstances to the court and any advocates for you.

Creditors' efforts to collect debt are temporarily halted upon filing for bankruptcy. Foreclosure notices and harassing phone calls are terminated. Whether you get the discharge of most or all of your obligations depends on the form of bankruptcy you file.

Most people who file for Chapter 7 bankruptcy do so in order to partially recoup their unsecured obligations by liquidating nonexempt assets. On the other hand, there are some things you can keep in different proportions, such as your own car, tools for your trade, and home equity. A reorganization plan that calls for cutting costs and raising revenue must be approved by the court. The court will liquidate your assets and divide them among creditors if the reorganization is unsuccessful. Title 11 of the United States Code contains the country's bankruptcy laws.

Disposition of Assets

Sometimes there's no need for liquidation, particularly for people with nonexempt assets like priceless collections (like coin or stamp collections) or family heirlooms. In some situations, filing for bankruptcy enables debtors to liquidate assets and gradually pay back creditors.

This is referred to as Chapter 7 bankruptcy in the US. On the other hand, in Canada, debtors have the option to submit a consumer proposal (Division I) which suspends credit collection actions while the debtor arranges a repayment plan to creditors over a maximum of ten years for firms and three to five years for individuals.

The intricate field of bankruptcy law is regulated by numerous federal acts and regulations. Norton Bankruptcy Law and Practice, 3rd ed. (KF1524.N76722 and on Westlaw) is a thorough treatment of the subject and includes annotated legislative history from the Code's adoption to the present. Collier on Bankruptcy, 16th ed. (KF1524 on Reserve, earlier editions on HeinOnline) is another great resource. Online access is also provided by the ABA's Bankruptcy Deadline Checklist.

Exclusivity

Your ability to retain certain assets is contingent upon the bankruptcy exemptions you assert. Exemptions are meant to safeguard the kinds of assets that people require to survive and rebuild their lives, such as clothing, household items, tools for their trades, a home, and a vehicle.

In order to pay off unsecured debts, a trustee might need to dispose nonexempt assets. The trustee will often sell the items with the highest value first. These assets include precious collections, investments in stocks, second residences, investment properties, inheritances, and other properties whose value is higher than what you owe on them.

Regular income earners can also utilize chapter 13 to prevent their property from being liquidated by creating a repayment plan that enables them to make up missed mortgage payments and retain other assets like cars, some home equity, furniture, clothing, and utilities. It's crucial to realize that doing so requires you to continue making mortgage payments on time.

Debtors

The people who owe money are known as creditors. The process for deciding which creditors receive repayment and in what sequence is laid forth in bankruptcy legislation. Frequently, this changes based on whether the debt is unsecured or secured. While unsecured debts often do not recover any assets unless the bankruptcy court permits such a distribution, secured debts are allowed to reclaim the object that served as collateral for the debt.

People who have a steady source of income can file under Chapter 13, which enables them to create manageable repayment schedules for their debts that are paid off gradually. This permits people to retain different proportions of their personal cars and home equity.

Only a limited range of debts, including alimony, child support, the majority of college loans, tax obligations, and fines from criminal offenses, are often discharged by bankruptcy courts. An involuntary petition for bankruptcy, however, can be a useful option if you are being threatened by aggressive creditors who have a track record of obtaining unsecured debts and using illegal means to acquire their payments.

Stay Updated

Actionable growth insights, once a week. No fluff, no spam—unsubscribe anytime.

You May Like

Your online shopping rights

08/01/2025

Comparing Liability and Collision: Knowing Your Options for Auto Insurance

07/11/2025

Senior Health Insurance: Medicare and Beyond

08/28/2025

Estate planning and charitable giving

06/21/2025

Selecting the Ideal Health Insurance Program for Your Needs

07/24/2025

How Much Is Enough to Put Down on a Mortgage Loan?

07/20/2025

Disability Insurance: Safeguarding Your Income in the Event of an Unexpected Situation

06/13/2025

Becoming Eligible for a Mortgage as a New Purchaser

07/31/2025

Recognizing Various Mortgage Types

06/26/2025

Auto Loans: Things to Take into Account While Financing a New or Used Vehicle

06/23/2025

Plea Agreements and Penalties

06/12/2025

Defending Your Property Against Theft: Advice From Renters Insurance

06/13/2025

Disability Benefits for Independent Contractors

08/16/2025

Chronic Conditions and Disability Insurance: What You Should Know

07/07/2025

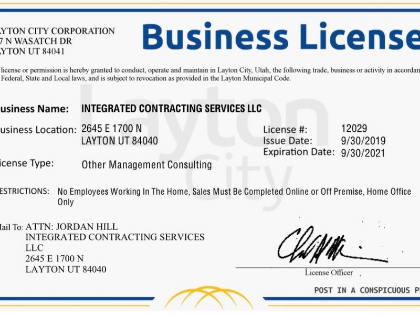

The Value of Obtaining the Appropriate Licenses and Permits for Your Business

07/24/2025

Where to Apply for a Car Loan

07/03/2025

Knowing the Differences Between Medicaid and Long-Term Care Insurance

06/10/2025

What You Need to Know About Renters Insurance and Subletting

06/16/2025

Getting Ready for College? Employ a student loan estimator.

09/01/2025

The Advantages of Loan Refinancing at High Interest Rates

07/09/2025

Factors in the Economy That Impact Mortgage Rates

08/25/2025

How Much Do Personal Loans Cost?

06/22/2025

Trends and Innovations for Debt Consolidation Loans in the Future

06/16/2025

The Price of a Mortgage Refinancing

06/20/2025

Comments

CipherScholar · 06/30/2025

Curious how beginners adapt this?

MosaicHarbor · 07/08/2025

Predicts compounding gains.

QuantumSprout · 06/22/2025

Balanced optimism vs. realism.