Selecting the Ideal Health Insurance Program for Your Needs

Advertisement

For both individuals and families, selecting the best health insurance plan is a crucial choice. There are other things to take into account, including the price and benefits of the coverage.

Select a plan that will cover your family's medical needs for the upcoming year by taking that into account. To compare plan alternatives and select the one that best suits your needs, use a plan comparison tool.

Price

While selecting a health insurance plan, it's critical to consider both cost and coverage. In addition to the monthly premium, you need to consider the out-of-pocket expenses, which include copayments and deductibles. Additionally, confirm that the plan's network includes the physicians, clinics, and pharmacies of your choice. You can be spending a lot more money out of pocket than is required if they aren't.

Think about your past medical experiences as well as any impending medical requirements, such as prescription drugs or scheduled surgeries. Next, review each plan's annual cost projections for average individuals. Next, determine if the costs of the plans are affordable for you.

If you're ready to pay a higher monthly premium in exchange for a larger insurance payment on your medical bills, for instance, a Gold plan can be a suitable fit for you. However, a Bronze plan can be less expensive if you don't take much care. During open enrollment or a special enrollment period—which occurs when you get married, have a child, move to a new zip code, or lose other healthcare coverage—you can assess your medical use.

Interaction

When selecting a health insurance plan, the network of providers that you have access to is crucial. Certain plans restrict your options and force you to use providers, hospitals, and pharmacies within their network. We refer to these as managed care programs. Point-of-service plans (POSs), PPOs (Preferred Provider Organizations), and HMOs (Health Maintenance Organizations) are a few examples. In most cases, these plans demand that you consult a primary care physician for a recommendation before visiting a specialist.

If you decide to buy a managed health care plan, search for one with a sizable local physician network. You won't have to pay expensive medical bills because of this. Make sure to contrast the premium prices of other plans as well. Avoid purchasing a policy that won't adequately protect your family out of haste. In the long term, this might be expensive.

Advantages

It's critical to assess the benefits and coverage offered, whether you purchase via your workplace or on your own. Think about the medical history of your family and any impending medical requirements, such as planned surgery or prescription medication. Examining each plan's supplier directory is also a smart idea. Seek out an in-network physician and hospital directory.

To ensure that you are receiving the best value for your money, you should constantly compare plans that have comparable coverage and costs. For example, certain plans may offer a higher sum insured or no claim bonus, while others may offer other benefits like dental and vision coverage.

It is advisable to contemplate whether you would choose a high-deductible plan or one with a reduced premium. Higher out-of-pocket expenses are sometimes associated with cheaper monthly premiums; however, the majority of your care is covered by the plan once your deductible is met. Although there is a greater selection of doctors through Preferred Provider Organizations, you might still need to see your primary care physician, who will manage your treatment and make specialist referrals.

Restrictions

Selecting the best health insurance plan involves making a number of complex decisions. Regretfully, a few individuals select the incorrect plan, incurring annual expenses of thousands. Thankfully, there are actions you can take to ensure you make the best decision.

Think about your priorities regarding cost, flexibility, and doctor choice when comparing various plans. Additionally, search for a plan with nearby in-network urgent care facilities and coverage for ER visits.

Remember that you might be eligible for financial assistance programs like tax credits or subsidies, which lower your monthly premium. When selecting a plan, you should also take your family's medical needs into account.

Enlightening staff members about their options can assist them in selecting the best health insurance plan. Employers can also offer instructional materials to make people feel confident about making an informed decision during open enrollment and help them understand their alternatives. Furthermore, it's critical to keep in mind that plan modifications are only possible during the open enrollment period.

Recommended Reading:

Loan Calculators' Restrictions →

Stay Updated

Actionable growth insights, once a week. No fluff, no spam—unsubscribe anytime.

You May Like

Disability Benefits for Independent Contractors

09/01/2025

Getting Ready for College? Employ a student loan estimator.

07/26/2025

Auto Loans: Things to Take into Account While Financing a New or Used Vehicle

07/03/2025

The Value of Intellectual Property to Both Individuals and Businesses

08/21/2025

Selecting the Ideal House for Your Requirements as a First-Time Purchaser

08/22/2025

Factors in the Economy That Impact Mortgage Rates

06/22/2025

The Advantages of Loan Refinancing at High Interest Rates

06/22/2025

How Much Is Enough to Put Down on a Mortgage Loan?

07/04/2025

Knowing the Differences Between Medicaid and Long-Term Care Insurance

06/18/2025

Your online shopping rights

08/07/2025

Current Trends and News on Mortgage Rates

07/28/2025

Where to Apply for a Car Loan

07/28/2025

What You Need to Know About Renters Insurance and Subletting

07/13/2025

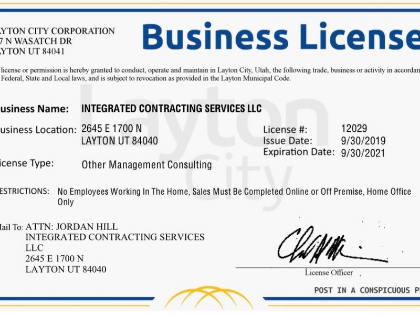

The Value of Obtaining the Appropriate Licenses and Permits for Your Business

07/08/2025

Disability Insurance: Safeguarding Your Income in the Event of an Unexpected Situation

07/09/2025

Defending Your Property Against Theft: Advice From Renters Insurance

06/15/2025

Becoming Eligible for a Mortgage as a New Purchaser

06/08/2025

Trends and Innovations for Debt Consolidation Loans in the Future

08/27/2025

The Price of a Mortgage Refinancing

07/09/2025

Innovations and Trends in Refinancing in the Future

06/08/2025

Estate planning and charitable giving

06/15/2025

Senior Health Insurance: Medicare and Beyond

06/19/2025

Bankruptcy Law: A Financial Recuperation Tool

08/04/2025

Red Flags from Mortgage Lenders: Things to Look Out for

08/05/2025

Comments

HorizonWeaver · 08/28/2025

Graceful handling of nuance.

SolarHatch · 07/29/2025

Helps surface silent assumptions.

RadiantCipher · 06/26/2025

Quality-to-length ratio high.