Selecting the Ideal House for Your Requirements as a First-Time Purchaser

Purchasing your first house may be both exhilarating and demanding. There are many factors that go into a successful house search, regardless of your reasons for wanting to move on from your current rental, building credit, or saving for a down payment.

Evaluate your budget first. Determine a reasonable purchase price using a mortgage calculator, and then get in touch with a lender to find out whether you'll be authorized for that sum.

1. Place

"Location, location, location," as the adage goes. It's true that where you live has a big impact on how well you purchase, sell, and live. It's crucial for first-time buyers to consider their desired location and how it will fit into their lifestyle.

List the things you absolutely must have in your new home (feel free to include any wants). After that, talk about these with your home loan professional and real estate agent so they can assist you in finding a home that satisfies all of your requirements.

As you start your search, it's crucial to take the future home's resale value into account. When it comes time to sell, look for communities with excellent schools, convenient access to the city, and lots of places to shop and have fun. These attributes frequently raise home values. Think about the travel times to important locations, such as your place of employment. A lengthy daily commute might lower your quality of life and cause stress. Think about an area that has convenient access to bus, rail, and public transportation routes.

2. Dimensions

Prioritize your necessities and wants when looking for a new residence. A gazebo or swimming pool, for instance, are great to have, but more sensible factors to take into account are how many bedrooms and bathrooms your family requires and whether the neighborhood is close to where you work.

The amount of space you desire in each room and the design of the house will also influence the size of your future residence. For example, you might like a house with a big kitchen or an open floor plan. Selecting the appropriate size for your home can help guarantee that you have enough space for both your present furniture and any future additions.

Additionally, bear in mind that a larger home usually comes with higher prices and that you'll need to be eligible for a higher mortgage. To find out what you can afford, get preapproved for a mortgage before you go house hunting. Freddie Mac's Home Possible (r) program or Rocket Mortgage from Fannie Mae (r) can be used for this. This is a critical step that will enable you to fulfill your aspirations of becoming a homeowner.

3. Facilities

Examine the amenities that are essential to your way of life when you have a comprehensive list of your housing requirements. These could be items like a large backyard or a swimming pool. A home's prospective future value with particular facilities could also be something to think about. For example, homes with pools tend to appreciate in value over time.

Certain facilities cannot be compromised. These are necessities, like a functional electrical system and a respectable plumbing system. Others are not necessary, but they are pleasant to have. These could incorporate elements like exposed brickwork and tall ceilings.

Remember that you can receive additional incentives as a first-time buyer, which can help lower the cost of purchasing a home. These consist of grants for first-time homebuyers, flexible credit scores, and low down payments. These may help you move into your ideal house faster than you might imagine if you meet the requirements. Speak with your real estate representative right away if you're unsure if you qualify. They can help you locate a lender that meets your needs and walk you through the procedure.

4. Cost

Although it might be a scary process, purchasing your first home is an exciting moment. It might be challenging to determine whether or not an asking price is reasonable if you lack experience. Furthermore, as a first-time buyer, it can be challenging to understand which local financing programs are accessible to you.

Obtaining preapproval is the best approach to making sure you can afford the purchase price and continuing expenditures of homeownership if you intend to finance your purchase with a mortgage. Remember that closing charges may total between three and four percent of the purchase price.

When you're prepared to seek a place to call home, list the features you would want. Don't forget to include the extras that would be wonderful to have in your new house in addition to the necessities. You can find properties that meet every requirement on your list with the assistance of your real estate agent. When the time comes to make a purchase, your realtor can also help you with the loan application procedure and negotiation techniques. On closing day, don't forget to spend some time carefully reading your mortgage documentation and asking your real estate agent any questions you may have.

5. Money

You might be eligible for a number of incentives as a first-time buyer, which might lower the cost of purchasing a home. These are mortgage schemes backed by the government that have more lenient credit score standards and require less of a down payment. Additionally, you can qualify for tax benefits and other benefits that state and municipal governments provide to purchasers.

It is vital to possess a comprehensive comprehension of the optimal financing alternatives available to you. Looking around for the best mortgage lenders with the lowest rates and fees should be your first step. Additionally, you should be ready to give the loan application underwriter comprehensive financial records, including income, savings, and debt-to-income ratios.

It's easy to believe that your first home will be your permanent home, yet most people outgrow their first residence within ten years. When purchasing a property, you should think about whether it would be a wise investment for your long-term requirements and objectives. The most effective approach to accomplishing that is to jot down your needs and desires.

Stay Updated

Actionable growth insights, once a week. No fluff, no spam—unsubscribe anytime.

You May Like

Chronic Conditions and Disability Insurance: What You Should Know

09/04/2025

Estate planning and charitable giving

07/31/2025

The Value of Intellectual Property to Both Individuals and Businesses

07/09/2025

Selecting the Ideal House for Your Requirements as a First-Time Purchaser

08/20/2025

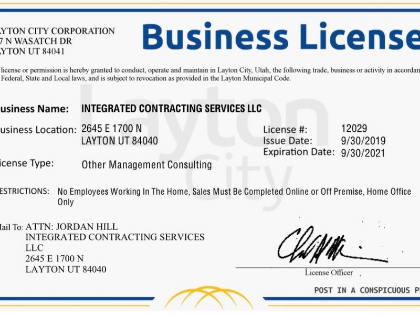

The Value of Obtaining the Appropriate Licenses and Permits for Your Business

06/27/2025

Taking a Personal Injury Case to Trial

07/22/2025

Becoming Eligible for a Mortgage as a New Purchaser

07/24/2025

Recognizing Various Mortgage Types

08/02/2025

Your online shopping rights

08/08/2025

Emergency Money: When to Take into Account a Personal Loan

07/17/2025

Innovations and Trends in Refinancing in the Future

07/11/2025

Senior Health Insurance: Medicare and Beyond

07/09/2025

A Guide to Comprehending Your Taxes and Filing Your Return

06/21/2025

Where to Apply for a Car Loan

06/08/2025

Selecting the Ideal Health Insurance Program for Your Needs

06/11/2025

Trends and Innovations for Debt Consolidation Loans in the Future

06/20/2025

Comparing Liability and Collision: Knowing Your Options for Auto Insurance

06/26/2025

The Advantages of Loan Refinancing at High Interest Rates

08/02/2025

The Price of a Mortgage Refinancing

08/13/2025

Defending Your Property Against Theft: Advice From Renters Insurance

06/09/2025

How Much Do Personal Loans Cost?

07/14/2025

Keeping Up With Legal Matters

07/20/2025

Disability Benefits for Independent Contractors

07/20/2025

Knowing the Differences Between Medicaid and Long-Term Care Insurance

06/30/2025

Comments

PineVoyager · 07/23/2025

Plays nicely with composability.