Chronic Conditions and Disability Insurance: What You Should Know

Disability insurance can be helpful for people whose medical conditions prevent them from working. Nevertheless, there are a few considerations to make before acquiring disability insurance.

In contrast to limitations linked to mobility, senses, or education, the symptoms of chronic illnesses can be debilitating, erratic, and unstable. Because of this, they differ from other types of disabilities and can need modifications that aren't typically provided in work environments.

Prior to Existence

Disability insurance coverage may be impacted by pre-existing conditions in a number of ways. Depending on the circumstances, they could impose a waiting period, shorten the policy's duration, or exclude particular categories of disability.

Insurance companies will review medical information, including doctor visits and medications, when deciding whether to exclude a certain pre-existing disease. They will also consider the time of symptom onset and the timing of treatment. We refer to this as the lookback phase.

Certain illnesses, such as cancer, are deemed pre-existing and may not be covered by a policy for disability insurance. But if you get a back injury and the insurance company can show that it has nothing to do with your cancer treatments, they might change their mind.

Any long-term medical issues should be declared when submitting an application for disability coverage. If you don't, your claim can be rejected later on. You can locate a policy that meets your needs and manage the procedure with the assistance of an independent disability agent.

Definitions of disability

The policy's operation is determined by the disability definition, which makes it crucial. Certain policies, for instance, only pay out under the own-occupation definition if your sickness or injury keeps you from working at your normal job. Some offer an any-occupation definition that covers benefits in the event that your sickness or disability keeps you from performing any job in the general labor force.

With regard to the latter kind of coverage, insurers must use caution in defining a general employment limitation. It is prohibited by the Americans with Disabilities Act (ADA) to discriminate against an individual who has a visible handicap that "substantially limits major life activities."

Many insurers use what's known as a "look-back period," during which they verify if you had a pre-existing condition at the time of policy enrollment, to avoid being caught by these regulations. It's vital that you be truthful about your health when applying for the policy because of this. A claim denial could occur from failing to comply with this.

Options for Coverage

A lot of people choose to purchase disability coverage on their own, outside of their employment. These might cover a greater range of pay sources, including bonuses, commissions, contributions to retirement plans, and incentives, making them more all-inclusive. Furthermore, unique policies often provide more accommodating definitions of disability and can permit premium waivers for disabled people.

Choosing the disability insurance that best meets your needs might be assisted by a financial expert. Make sure the policy has an own-occupation definition of disability, and ask them to take into account a cost-of-living adjustment provision that automatically raises the benefit amount for inflation, as well as a future increase option rider that lets you boost your benefits as you heal. You can also include a residual disability rider, which would increase your premiums but would let you return to work on a part-time basis. The majority of short- and long-term disability policies can have these characteristics added.

Premiums

It's crucial to weigh your premium options while selecting disability insurance in order to determine how much coverage you might get in the event of a disability. It is advisable to contemplate additional coverage options like critical illness and cancer insurance, which offer lump-sum payouts for particular diagnoses and treatments.

According to the National Association of Insurance and Financial Advisors (NAIFA), the cost of an individual long-term disability policy ranges from 1% to 3% of your salary. Policies provided by your employer expire when you quit, but you can get a portable individual policy.

You should consider how soon you might require disability payments in addition to how much you can afford to spend in premiums when selecting long-term disability coverage. For instance, you might have to provide a medical document proving that your discomfort is related to an underlying illness if you have lupus or fibromyalgia, two chronic conditions. If not, your claim can be rejected.

Stay Updated

Actionable growth insights, once a week. No fluff, no spam—unsubscribe anytime.

You May Like

Senior Health Insurance: Medicare and Beyond

07/26/2025

Becoming Eligible for a Mortgage as a New Purchaser

08/05/2025

Disability Benefits for Independent Contractors

08/27/2025

Red Flags from Mortgage Lenders: Things to Look Out for

07/17/2025

Where to Apply for a Car Loan

08/12/2025

Disability Insurance: Safeguarding Your Income in the Event of an Unexpected Situation

07/05/2025

Innovations and Trends in Refinancing in the Future

06/23/2025

Comparing Liability and Collision: Knowing Your Options for Auto Insurance

07/02/2025

Chronic Conditions and Disability Insurance: What You Should Know

07/24/2025

Recognizing Various Mortgage Types

07/05/2025

Estate planning and charitable giving

08/12/2025

Selecting the Ideal House for Your Requirements as a First-Time Purchaser

07/10/2025

The Value of Intellectual Property to Both Individuals and Businesses

09/01/2025

Current Trends and News on Mortgage Rates

07/27/2025

Your online shopping rights

07/17/2025

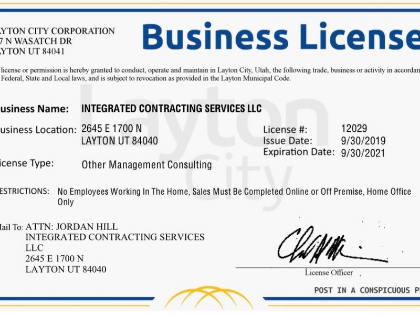

The Value of Obtaining the Appropriate Licenses and Permits for Your Business

07/09/2025

Emergency Money: When to Take into Account a Personal Loan

08/22/2025

Keeping Up With Legal Matters

08/21/2025

The Advantages of Loan Refinancing at High Interest Rates

07/03/2025

Knowing the Differences Between Medicaid and Long-Term Care Insurance

06/07/2025

Bankruptcy Law: A Financial Recuperation Tool

08/19/2025

What You Need to Know About Renters Insurance and Subletting

06/19/2025

How Much Is Enough to Put Down on a Mortgage Loan?

07/17/2025

Plea Agreements and Penalties

07/14/2025

Comments

GlacierSignal · 09/05/2025

Elegant constraint application.

DriftParagon · 07/02/2025

Worth a lunch‑and‑learn session.