Factors in the Economy That Impact Mortgage Rates

Advertisement

Your mortgage rate is contingent on the state of the economy. Mortgage rates typically rise in periods of strong economic development and job creation.

The demand for mortgage bonds, also known as mortgage-backed securities (MBS), by investors determines how much interest mortgage lenders will charge. Rates climb in periods of strong demand and decrease in periods of low demand.

Growth of the Economy

Mortgage rates are directly impacted by economic growth and how it affects consumers' purchasing power as homeowners. Borrowers have more money available to them for housing and other purchases while the economy is expanding, which influences the dynamics of the real estate market.

But when the economy weakens, so does the purchasing power of consumers, which lowers the demand for home loans. The supply of mortgage-backed securities rises when the demand for mortgage loans declines. Mortgage rates rise as a result of this.

Variations in investor confidence in the economy also result in higher mortgage rates. Investors may lose faith in the economy as a result of unforeseen catastrophes like natural disasters, terrorist attacks, and political unrest, which may lead them to shift their funds into more reliable investments like mortgage bonds. Consequently, mortgage rates decline. Another element influencing mortgage rates is inflation. Because a steady pace of inflation gradually reduces the purchasing power of cash, mortgage lenders keep a careful eye on it.

The inflation rate

Mortgage rates are directly impacted by inflation since it reduces consumers' purchasing power. Lenders hike interest rates in response to the erosion of consumer purchasing power caused by excessively high inflation, which may ultimately make mortgage loans less accessible to potential homebuyers.

When determining mortgage rates, lenders also take investors' projections of future inflation into account. A higher average mortgage rate may result from investors demanding higher yields on mortgage-backed bonds than would otherwise be the case if they anticipated rising inflation.

Because of this, astute prospective homeowners can keep an eye on inflation indicators and modify their expectations accordingly, possibly saving thousands of dollars over the course of their mortgages. For example, they might choose to lock in their mortgage rate before it increases if they observe that inflation is starting to decline. This can assist in avoiding overspending on a house or pricing oneself out of the market completely. Although there is a connection between inflation and mortgage rates, it can be difficult to explain.

Workplace

The state of the economy as a whole and market conditions have a significant impact on mortgage rates. Homeowners and purchasers may be able to make wiser financial decisions and save thousands of dollars over the course of their loans by monitoring economic indicators.

For instance, higher unemployment rates equate to lower purchasing power due to a shortage of money. This may result in higher inflation, which might raise interest rates on mortgages. On the other hand, when investors seek the security of bonds like mortgage-backed securities, declining employment rates are indicative of a better economy and cheaper mortgage rates.

Lenders of mortgages must maintain competitive rates because they are in competition with one another for business. This keeps them appealing to clients and keeps them competitive.

The Federal Reserve

Mortgage rates fluctuate in response to general economic trends, in addition to being influenced by specific criteria such as loan types and credit ratings. Bond prices fluctuate in response to investor demand for high or low yields in the financial markets, and this affects mortgage interest rates as well. Mortgage rates typically increase when the economy is robust and there is a significant demand for bonds among investors.

On the other hand, mortgage rates usually decrease when the economy slows and investor demand for bonds decreases. Mortgage rates are significantly influenced by the Federal Reserve's monetary policy choices. Longer-term interest rates, such as mortgage rates, are indirectly impacted by the federal funds rate, which is determined by the Federal Reserve. However, this effect takes some time to materialize.

Mortgage interest rates frequently increase in tandem with Fed rate hikes, which are intended to control inflation. This is due to the fact that rising rates make borrowing money more costly for lenders and banks, which drives up the cost of mortgages.

Recommended Reading:

Auto Loans: Things to Take into Account While Financing a New or Used Vehicle →

Stay Updated

Actionable growth insights, once a week. No fluff, no spam—unsubscribe anytime.

You May Like

Taking a Personal Injury Case to Trial

06/20/2025

Senior Health Insurance: Medicare and Beyond

08/08/2025

Plea Agreements and Penalties

08/18/2025

Loan Calculators' Restrictions

07/09/2025

Trends and Innovations for Debt Consolidation Loans in the Future

09/05/2025

Emergency Money: When to Take into Account a Personal Loan

07/18/2025

Auto Loans: Things to Take into Account While Financing a New or Used Vehicle

07/28/2025

Factors in the Economy That Impact Mortgage Rates

08/31/2025

Chronic Conditions and Disability Insurance: What You Should Know

07/13/2025

Disability Insurance: Safeguarding Your Income in the Event of an Unexpected Situation

08/22/2025

Current Trends and News on Mortgage Rates

07/30/2025

Becoming Eligible for a Mortgage as a New Purchaser

09/04/2025

Keeping Up With Legal Matters

07/16/2025

Your online shopping rights

08/16/2025

Getting Ready for College? Employ a student loan estimator.

08/16/2025

Innovations and Trends in Refinancing in the Future

08/21/2025

What You Need to Know About Renters Insurance and Subletting

06/23/2025

Where to Apply for a Car Loan

08/05/2025

A Guide to Comprehending Your Taxes and Filing Your Return

06/25/2025

How Much Is Enough to Put Down on a Mortgage Loan?

06/15/2025

Red Flags from Mortgage Lenders: Things to Look Out for

06/19/2025

Knowing the Differences Between Medicaid and Long-Term Care Insurance

07/03/2025

Disability Benefits for Independent Contractors

06/27/2025

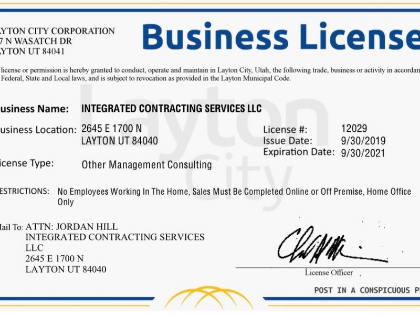

The Value of Obtaining the Appropriate Licenses and Permits for Your Business

08/06/2025

Comments

VelvetAtrium · 07/07/2025

Lightweight but sticky.

RuneVoyager · 06/22/2025

Embeds context elasticity.

LanternWarden · 08/18/2025

Clean handshake between concepts.

JadeSurveyor · 07/04/2025

Friendly to progressive enhancement.