Emergency Money: When to Take into Account a Personal Loan

Advertisement

An essential component of any financial strategy is an emergency fund. Unexpected costs can mount up rapidly, leaving you with little choice but to use credit cards or loans to pay for them.

Your emergency funds should ideally be kept in a separate account. This will enable you to monitor your progress toward your objective and prevent you from raiding it to pay for additional purchases.

1. Unexpected medical expenses

Any budget must include an emergency reserve since it acts as a safety net against unforeseen costs. These costs may consist of lost wages, auto or home repairs, medical bills, and more. In the absence of a readily accessible emergency savings account, unforeseen costs may compel individuals to depend on credit cards and loans, which have the potential to rapidly accumulate debt.

Even though setting aside money for an emergency fund can take some time, you can achieve your goal by making budget adjustments, looking for ways to cut costs, and looking into extra sources of income like a side gig or a periodic tax refund. Regularly reviewing your spending can also assist in identifying expenses that can be moved to the emergency savings account, such as eating out or magazine subscriptions.

A decent rule of thumb is to save enough money for three to six months' worth of costs, while the size of an emergency savings account might vary depending on lifestyle, budget, and monthly spending. At first, this sum could seem overwhelming, but if you save a little each week or two, you can reach your goal sooner.

2. Unexpected Home Maintenance

Emergency savings can be used to pay for necessary home repairs, such as fixing a shattered window or a broken furnace in the dead of winter.

Utilizing your emergency reserves for these costs also keeps you from incurring debt that could lead to future worries and expenses. This is especially crucial if you work for yourself or have an unpredictable income, because those situations could call for a larger safety net to handle unforeseen expenses.

Although there is no set amount for an emergency fund, experts generally advise accumulating three to six months' worth of costs. This objective can be easier to achieve and you can avoid taking up high-interest credit cards or loans that could quickly put your finances in danger by setting aside a small amount of money each month. Use a money market account or high-yield savings account with check-writing and debit card capabilities to increase the amount of money you have set aside for emergencies. This will guarantee accessibility when you need it most and optimize the amount of money you have.

3. Unpredicted Costs

It's critical to keep in mind that using your emergency fund for non-essential expenses defeats the purpose for which it was created—to cover actual crises. It's best to keep the account distinct from your principal funds and to have a clear approach for determining whether a cost is indeed urgent. This can assist you in avoiding snap decisions that might jeopardize your safety net of finances.

Generally speaking, you should aim to save three or six months' worth of living expenses. Although it can seem impossible to achieve, you can begin small and progressively grow your savings over time. Additionally, it's a good idea to store these savings in a different account—like a CD, prepaid card, or high-yield savings account—than your regular savings or checking account. This will discourage spending and emphasize how important the goal of this account is.

4. Unexpected Loans

Generally speaking, financial advisors advise against using your emergency savings. This is because, if done incorrectly, it may jeopardize your long-term savings objectives and create a vicious cycle of reliance on credit cards or loans.

Emergency savings are intended to pay for unanticipated costs that are difficult to predict, such as a sudden medical emergency or job loss. It is generally advised that you have three to six months' worth of living expenses saved up in your emergency fund.

Although saving that much might seem overwhelming at first, you can start by setting small objectives. Try saving $25 a week, for instance, and as you get more accustomed to the process, raise your target. Maintaining your emergency savings in a convenient location is also crucial. This covers certificates of deposit, money market accounts, and savings accounts covered by the FDIC. However, if they think your request is unlawful or suspicious, many banks have the ability to hold off on allowing withdrawals from savings accounts.

Recommended Reading:

Taking a Personal Injury Case to Trial →

Stay Updated

Actionable growth insights, once a week. No fluff, no spam—unsubscribe anytime.

You May Like

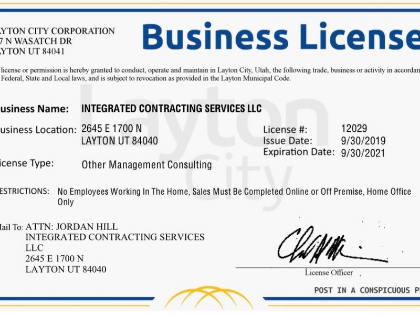

The Value of Obtaining the Appropriate Licenses and Permits for Your Business

07/07/2025

Selecting the Ideal House for Your Requirements as a First-Time Purchaser

09/01/2025

Your online shopping rights

08/08/2025

Disability Insurance: Safeguarding Your Income in the Event of an Unexpected Situation

06/27/2025

Comparing Liability and Collision: Knowing Your Options for Auto Insurance

07/14/2025

Recognizing Various Mortgage Types

06/15/2025

A Guide to Comprehending Your Taxes and Filing Your Return

06/26/2025

The Advantages of Loan Refinancing at High Interest Rates

08/02/2025

Defending Your Property Against Theft: Advice From Renters Insurance

07/04/2025

Becoming Eligible for a Mortgage as a New Purchaser

07/16/2025

What You Need to Know About Renters Insurance and Subletting

07/16/2025

Where to Apply for a Car Loan

07/11/2025

Bankruptcy Law: A Financial Recuperation Tool

09/04/2025

Factors in the Economy That Impact Mortgage Rates

06/19/2025

Taking a Personal Injury Case to Trial

07/17/2025

The Value of Intellectual Property to Both Individuals and Businesses

08/21/2025

The Price of a Mortgage Refinancing

08/05/2025

Auto Loans: Things to Take into Account While Financing a New or Used Vehicle

07/19/2025

Keeping Up With Legal Matters

08/18/2025

Innovations and Trends in Refinancing in the Future

08/20/2025

Emergency Money: When to Take into Account a Personal Loan

06/24/2025

Selecting the Ideal Health Insurance Program for Your Needs

08/09/2025

Getting Ready for College? Employ a student loan estimator.

08/27/2025

Trends and Innovations for Debt Consolidation Loans in the Future

08/09/2025

Comments

KineticHarbor · 06/14/2025

Fortifies decision auditability.

EmberAnchor · 06/13/2025

Anyone tested this under pressure?

AlloyNavigator · 06/13/2025

Provides a resilient baseline lens.

JadeNomad · 08/01/2025

Quietly unlocks strategic bandwidth.

DuskTelemetry · 06/29/2025

Who’s brave enough to disagree?