Current Trends and News on Mortgage Rates

The current generational highs in mortgage rates have severely limited the purchasing power of prospective homeowners. There is disagreement among specialists over the continuation of the trend.

The financial markets celebrated the slowdown in inflation, which may contribute to a slight reduction in mortgage rates later in the year or the following. However, there are worries that a shortage of available homes would drive up prices.

1. The Weekly Rate Survey by Freddie Mac

In the process of purchasing a home, mortgage rates are an important consideration. Prospective homebuyers can monitor changes in mortgage rates by subscribing to Freddie Mac's weekly mortgage market report.

Mortgage data was gathered by Freddie Mac's Primary Mortgage Market Survey (PMMS), which involved contacting lenders from a proportionately diverse range of lending institutions. But starting in November 2022, Freddie Mac has been using loan application data from its automated underwriting system, Loan Product Advisor, in place of this conventional method of obtaining mortgage rate information.

According to Freddie Mac, the average 30-year fixed mortgage rate decreased to 6.87% for the week ending on May 19. The average rate has not been this low in almost two months. These reduced mortgage rates, together with slower inflation, are encouraging signs for the housing market. It's crucial to keep in mind that average mortgage rates are merely meant to serve as a general guideline. The loan-to-value ratio and your individual credit profile will determine your mortgage rate.

2. The May Housing Forecast from Fannie Mae

Fannie Mae has revised down its prediction for the volume of mortgage originations this year and delayed the date on which it anticipates a recession to begin. This adjustment serves as a reminder of the intricate nature of mortgage market trends and the huge effects that even tiny percentage point fluctuations may have on both lenders and purchasers.

Persistently high mortgage rates deter prospective buyers from entering the market and encourage current homeowners to stay in their homes rather than list them for sale. The "lock-in" effect is contributing to the ongoing scarcity of available housing stock.

According to Fannie Mae experts, there is still potential for mortgage rates to decrease, and by the end of 2024, 30-year fixed-rate mortgages might be offered for less than 6%. This could encourage more refinancing and defrost the current housing market. The Economic & Strategic Research (ESR) Group of Fannie Mae's opinions, analyses, estimates, projections, and other viewpoints expressed in these materials should not be interpreted as a prediction of the company's future prospects or anticipated outcomes.

3. The May Forecast from the National Association of Realtors

A lot of prospective homebuyers would find it difficult to predict what mortgage rates might be like in 2024. In the end, they remain at historically low levels in comparison to 2020 and 2021.

However, don't jump to the conclusion that buyers of real estate won't see these kinds of alluring possibilities to purchase in the near future. Mortgage rates are expected to rise for several months before declining once more, according to a number of industry analysts and experts.

For instance, according to Freddie Mac's March Economic, Housing and Mortgage Market Outlook prediction, mortgage rates would continue to remain over 6.5% through the first half of 2024. This is due to the mortgage giant's prediction that the Federal Reserve will only lower interest rates once this year, meaning that mortgage rates will remain high through the end of 2024. Nevertheless, a lot of financial firms that work in the money markets believe that before the end of this year, and maybe even by the start of 2025, the Fed will have lowered interest rates.

4. The May Forecast from the Mortgage Bankers Association

The overall state of the economy and, to some extent, the Federal Reserve's monetary policies are two major determinants of mortgage rates. Inflation also affects mortgage rates since growing costs cause yields to decrease.

According to Freddie Mac's most recent projection, mortgage rates will continue to rise in the first half of 2024. The massive mortgage company did, however, add that it anticipates at least one rate drop by the Fed during this time.

According to the MBA's 2024 prediction, purchase origination volume is predicted to rise from $1.64 trillion in 2023 to $1.95 trillion the following year. Additionally, the association projects that the volume of loans originated for refinancing will increase from the 4.4 million anticipated in 2023 to 5.2 million in 2024.

According to experts, borrowers who have never refinanced might want to think about doing so in the future, particularly if mortgage rates drop later in the year. A rate reduction may enable borrowers to lower their monthly payments and save money over the course of the loan.

Stay Updated

Actionable growth insights, once a week. No fluff, no spam—unsubscribe anytime.

You May Like

Where to Apply for a Car Loan

06/11/2025

Getting Ready for College? Employ a student loan estimator.

08/18/2025

The Price of a Mortgage Refinancing

07/01/2025

Disability Insurance: Safeguarding Your Income in the Event of an Unexpected Situation

06/20/2025

Estate planning and charitable giving

06/17/2025

Bankruptcy Law: A Financial Recuperation Tool

09/04/2025

The Value of Intellectual Property to Both Individuals and Businesses

07/04/2025

Recognizing Various Mortgage Types

06/20/2025

Disability Benefits for Independent Contractors

07/10/2025

Senior Health Insurance: Medicare and Beyond

06/19/2025

Loan Calculators' Restrictions

08/30/2025

How Much Is Enough to Put Down on a Mortgage Loan?

08/25/2025

Red Flags from Mortgage Lenders: Things to Look Out for

07/30/2025

Plea Agreements and Penalties

07/06/2025

Emergency Money: When to Take into Account a Personal Loan

07/03/2025

Factors in the Economy That Impact Mortgage Rates

06/30/2025

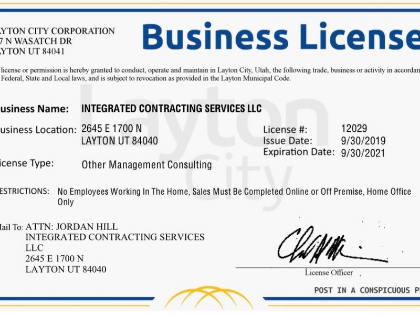

The Value of Obtaining the Appropriate Licenses and Permits for Your Business

06/28/2025

The Advantages of Loan Refinancing at High Interest Rates

07/27/2025

Chronic Conditions and Disability Insurance: What You Should Know

06/15/2025

Defending Your Property Against Theft: Advice From Renters Insurance

08/18/2025

Auto Loans: Things to Take into Account While Financing a New or Used Vehicle

07/27/2025

Selecting the Ideal Health Insurance Program for Your Needs

07/04/2025

What You Need to Know About Renters Insurance and Subletting

08/02/2025

Trends and Innovations for Debt Consolidation Loans in the Future

09/01/2025

Comments

GlacierNomad · 08/16/2025

Facilitates multi-horizon planning.