Comparing Liability and Collision: Knowing Your Options for Auto Insurance

Advertisement

Knowing the distinction between collision and comprehensive coverage is crucial when looking for auto insurance. Most states mandate liability insurance, which protects against harm and property loss brought on by the insured.

Physical damage coverage options like comprehensive and collision help support liability plans. Usually, people refer to them as full coverage.

Insurance Against Liability

Liability auto insurance typically pays for damages to other people's property or injuries sustained in an accident you cause. In the event that you are sued in relation to the accident, it also assists with paying your legal bills.

Even though most states have minimal liability coverage requirements, you might want to think about increasing your policy's limits to give yourself more financial security. But bear in mind that premiums will usually go up with increased liability coverage amounts.

On the other hand, if you cause an accident, comprehensive and collision insurance may help pay for the repairs to your car. They also assist in compensating you for losses resulting from non-accidental events such as theft or weather-related disasters (such as hail and falling trees). There is often a different deductible for each form of physical damage coverage, which you must pay before your insurance company will begin processing a claim. Depending on a number of variables, including your driving history, the car's value, and if you have a loan on it, the deductible amount may change.

Coverage for property damage

If you cause an accident that results in harm to another person's vehicle or other property (like a mailbox, fence, house, or building), your property damage liability insurance will pay for it. Additionally, it shields you from claims brought by accident participants against you for harm or losses brought on by your conduct. Typically, this kind of coverage comes with restrictions per person or per accident. Should your losses exceed this cap, the remaining expenses will need to be covered out of your own money.

Options like comprehensive and collision cover your car against harm not covered by liability insurance, saving you money. These two kinds of protection are sometimes bundled and referred to as full coverage. This may or may not be the best choice for you, depending on your choices and circumstances. For a free consultation to go over your alternatives and talk about your circumstances, contact us. Nationwide, accident victims are represented by our firm. Our mission is to assist you in obtaining the right and necessary financial protection.

Entire Coverage

Damage to your car resulting from circumstances other than collisions can be partially covered by a comprehensive auto insurance policy. A hailstorm, a tree collapsing, or vandalism are examples of this. It also protects your car in the event that it is stolen or damaged by an animal (such as a deer).

Most drivers will get comprehensive and collision coverage for their vehicles. In the event that you are financing or leasing a car, many lenders need complete coverage. Ascertain that you are obtaining the appropriate coverage by regularly reviewing your state's and your lender's requirements.

If a large portion of the value of your car has been lost, you may choose to forgo comprehensive coverage since it is probably not worth paying for in the event that your vehicle is destroyed or suffers damage. Nonetheless, it's usually a smart idea to keep your car if it's still relatively new and you can afford to pay for comprehensive insurance. In the unlikely event that your car is stolen or seriously damaged, it will help you save money on replacement costs.

Insurance Against Collisions

Regardless of who caused the accident, collision insurance helps cover the cost of any damage to your car. Usually, it covers accidents like running into a tree, another vehicle, or a building. Collision coverage is frequently provided by insurers as a component of complete coverage. In addition to comprehensive and collision coverage, a full coverage policy provides the minimum liability insurance required by the state, providing additional financial security in the event of an auto accident.

There is usually a deductible associated with both collision and comprehensive coverage options. When acquiring these coverages, you will select the deductible amount, which should be determined by your financial situation and the worth of your car.

Your lender will insist on collision coverage if you have a loan or lease on your car. If not, that is a matter of personal choice. You may assess if collision coverage is worthwhile for your circumstances with NerdWallet's collision coverage calculator.

Recommended Reading:

Auto Loans: Things to Take into Account While Financing a New or Used Vehicle →

Stay Updated

Actionable growth insights, once a week. No fluff, no spam—unsubscribe anytime.

You May Like

Your online shopping rights

07/23/2025

Knowing the Differences Between Medicaid and Long-Term Care Insurance

07/25/2025

Senior Health Insurance: Medicare and Beyond

07/18/2025

Innovations and Trends in Refinancing in the Future

08/29/2025

A Guide to Comprehending Your Taxes and Filing Your Return

06/18/2025

Keeping Up With Legal Matters

07/11/2025

Defending Your Property Against Theft: Advice From Renters Insurance

08/07/2025

Becoming Eligible for a Mortgage as a New Purchaser

08/10/2025

The Value of Intellectual Property to Both Individuals and Businesses

06/23/2025

Current Trends and News on Mortgage Rates

08/21/2025

Chronic Conditions and Disability Insurance: What You Should Know

08/18/2025

Loan Calculators' Restrictions

06/29/2025

Getting Ready for College? Employ a student loan estimator.

08/31/2025

Red Flags from Mortgage Lenders: Things to Look Out for

07/11/2025

The Advantages of Loan Refinancing at High Interest Rates

07/30/2025

Comparing Liability and Collision: Knowing Your Options for Auto Insurance

08/25/2025

Selecting the Ideal Health Insurance Program for Your Needs

07/22/2025

Recognizing Various Mortgage Types

06/25/2025

What You Need to Know About Renters Insurance and Subletting

07/03/2025

Taking a Personal Injury Case to Trial

07/29/2025

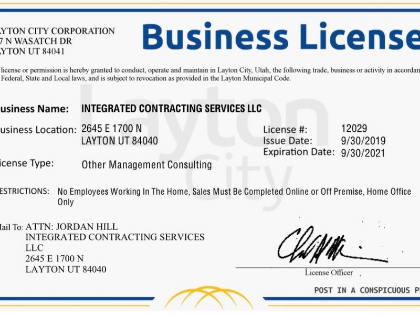

The Value of Obtaining the Appropriate Licenses and Permits for Your Business

07/06/2025

Plea Agreements and Penalties

07/23/2025

Disability Insurance: Safeguarding Your Income in the Event of an Unexpected Situation

06/21/2025

Factors in the Economy That Impact Mortgage Rates

07/31/2025

Comments

FrostedHarbor · 08/29/2025

Clean logic path.