Knowing the Differences Between Medicaid and Long-Term Care Insurance

Advertisement

Long-term care is required by millions of Americans. Depending on state regulations, individuals may have to pay for it out of pocket or with their own assets until they are eligible for Medicaid.

The majority of individuals believe Medicaid will cover their long-term care costs. That isn't always the case, though.

Prices

Medicaid is essential to the affordability and accessibility of long-term care for people who cannot afford to pay for it out of pocket. However, expenses can vary greatly because states set their Medicaid LTSS spending per enrollee as well as the wealth and poverty levels of individuals in different areas.

Medicare and Medicaid are used by many elderly people in need of LTSS. Furthermore, a lot of elderly people depend on unpaid LTSS from friends and relatives.

One more cost-effective option for covering LTSS expenses could be long-term care insurance plans. The benefit of maintaining personal assets is another. However, most insurance policies have underwriting requirements, and as you get older, your rates may increase.

The state of New York provides "Partnership Policies," which let policyholders get Medicaid without having to deplete their personal assets first. Not every state offers this choice, though. Go to the long-term care insurance plans website of the NYS Department of Financial Services for additional information.

Qualifications

Medicaid eligibility normally requires a very low income and few assets, though state-specific requirements may differ. According to Gleckman, many people who depend on Medicaid for long-term care wind up going bankrupt trying to meet the requirements of the program.

The long-term care insurance industry has filled the space left by seniors' desire to avoid this. The majority of plans are offered individually, while some businesses also make them available through associations and employers.

Those who buy long-term care insurance might be able to keep a portion of their earnings and continue to be eligible for Medicaid, which would pay for any expenses that are not covered by the policy. They should understand, though, that every state has its own set of regulations governing the handling and transfer of assets. When evaluating an applicant's financial situation over a five-year period, several states have "look back" periods that are used to determine eligibility for Medicaid long-term care services or home and community-based waiver programs.

Conditions

A common misconception is that Medicaid will cover all of a person's long-term care expenses. It's crucial to keep in mind that the program is solely intended to assist the underprivileged. Medicaid eligibility requirements might differ greatly because they depend on state regulations.

Furthermore, in order to be eligible for Medicaid coverage, you have to "spend down" a percentage of your income. Thankfully, there are a number of ways to lower your countable income (such as transferring a portion of your Social Security benefits into a qualifying income trust).

On the other hand, the premium for private long-term care insurance coverage is usually fixed for the duration of the policy. These rates remain the same unless the insurer requests permission from the Department to raise them on a class basis, in contrast to health insurance, which has an annual premium. These gains are sometimes determined by looking at the performance of all the policies that a company has purchased.

Choices

Some elderly people, especially those with low incomes and few assets, will rely on Medicaid to help pay for LTSS. State laws, however, differ and might be complicated. Prior to creating a plan, people must comprehend these distinctions.

Many long-term care insurance policies include a cash amount limit or maximum policy benefits that can be attained within a specific time frame (e.g., five years or lifetime). Additionally, some policies have inflation protection, which raises the benefit over time in a predetermined increment.

Individuals who fulfill the Medicaid income, asset, and health requirements (or who are enrolled as dual eligibles in Medicare and Medicaid) may be eligible for free or significantly reduced-cost custodial care in state-approved institutions. Seniors who want to cover some of their own costs for long-term care services (LTSS) can do so by purchasing services using money from personal savings or neighborhood resources or by purchasing private long-term care insurance.

Recommended Reading:

Chronic Conditions and Disability Insurance: What You Should Know →

Stay Updated

Actionable growth insights, once a week. No fluff, no spam—unsubscribe anytime.

You May Like

The Value of Intellectual Property to Both Individuals and Businesses

08/25/2025

Disability Insurance: Safeguarding Your Income in the Event of an Unexpected Situation

08/18/2025

Emergency Money: When to Take into Account a Personal Loan

06/22/2025

Senior Health Insurance: Medicare and Beyond

08/18/2025

Current Trends and News on Mortgage Rates

08/03/2025

What You Need to Know About Renters Insurance and Subletting

07/10/2025

Where to Apply for a Car Loan

08/28/2025

Taking a Personal Injury Case to Trial

07/14/2025

Knowing the Differences Between Medicaid and Long-Term Care Insurance

06/19/2025

Keeping Up With Legal Matters

07/14/2025

The Price of a Mortgage Refinancing

06/20/2025

Recognizing Various Mortgage Types

08/27/2025

Your online shopping rights

09/01/2025

Disability Benefits for Independent Contractors

08/17/2025

Chronic Conditions and Disability Insurance: What You Should Know

06/18/2025

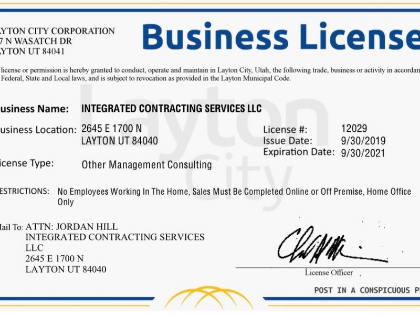

The Value of Obtaining the Appropriate Licenses and Permits for Your Business

07/09/2025

Selecting the Ideal Health Insurance Program for Your Needs

07/22/2025

Selecting the Ideal House for Your Requirements as a First-Time Purchaser

08/02/2025

Auto Loans: Things to Take into Account While Financing a New or Used Vehicle

08/29/2025

Defending Your Property Against Theft: Advice From Renters Insurance

07/07/2025

Loan Calculators' Restrictions

08/11/2025

How Much Is Enough to Put Down on a Mortgage Loan?

06/05/2025

The Advantages of Loan Refinancing at High Interest Rates

06/20/2025

Red Flags from Mortgage Lenders: Things to Look Out for

08/03/2025

Comments

EmberAnchor · 06/29/2025

The abstraction layer feels healthy.

QuantumBadger · 07/29/2025

Shows empathy for downstream roles.

AtlasRipple · 08/15/2025

Friction-aware semantics.