How Much Is Enough to Put Down on a Mortgage Loan?

Advertisement

A significant phase in the house-buying process is making a down payment. This sum is usually derived from qualifying donations or personal savings.

A down payment is required by lenders since it demonstrates their financial commitment to the deal and contributes to the property's equity. Monthly payments and loan size have also decreased.

What is your budget?

Although a down payment is a significant up-front investment, there are other costs involved in becoming a homeowner. Make sure you budget for recurring expenses for things like furnishings, utilities, and upkeep. It's also a good idea to budget for unforeseen costs and emergencies.

Numerous lenders provide mortgage plans with little to no down payment, and there are specific zero-down loan programs available for service members, veterans, and borrowers in rural areas. Make sure to evaluate all of your options so that you can determine how each will impact your overall expenses.

A higher down payment lowers the amount you will need to borrow, but it may also delay your homeownership and leave you with less money for other financial objectives, such as setting up an emergency fund.

How much are you able to save?

The more you can put down as a down payment up front, the less you'll need to borrow—conventional or government loans included. As a result, your monthly payments will be reduced and you will pay less interest overall on your mortgage.

If you are unable to save enough, you might be able to use presents from relatives. Gift money can be used as a down payment on government and conventional loans.

Refrain from using all of your emergency reserves to cover the down payment. That can put your financial stability in danger in the event that you lose your job or incur unforeseen costs.

What is the maximum amount you can spend?

One of the biggest expenses most people will incur in their lifetime is the cost of homeownership. It's critical to assess your entire financial situation and determine whether taking on such a large debt, especially over a number of decades, is a wise decision.

Lenders assess what you can afford using a range of models and guidelines. It's generally accepted that your monthly debt payments should not exceed 36% and your mortgage payments should not exceed 28% of your gross monthly income.

What Is Your Budget Allowed for Closing Expenses?

The amount of money you can afford to spend on closing costs will depend on your unique circumstances and ambitions, regardless of whether you want to build or purchase an existing home. Larger down payments typically result in lower closing costs and longer-term financial savings.

For many purchasers, however, saving up for a conventional 20% down payment would not be feasible. Fortunately, borrowers wishing to reduce their down payment have a plethora of options at their disposal. Fannie Mae HomeReady provides a conventional loan with even lower down payment requirements, and conventional mortgage lenders offer programs with as little as 3% down.

What Is the Maximum Amount You Can Spend on Upkeep?

Purchasing a home has numerous costs. There are other expenses, like homeowners insurance and property taxes, on top of the mortgage payment. Furthermore, maintenance expenses might add up.

The maintenance costs of your home should be kept between 1% and 4% of its worth, according to experts. However, calculating how much to save might be difficult.

A home warranty, which may pay for all or part of the expense of upkeep, is an option for some homeowners. This might lessen the anxiety caused by unforeseen maintenance and repair expenses. However, remember to account for the yearly or monthly premium.

What Is the Maximum Amount You Can Spend on Repairs?

It can help you qualify for a lower interest rate and spend less on loan costs if you have enough savings to make a substantial down payment. The secret is to budget your money and save as much as you can reasonably afford, with an emergency fund included.

There are alternative possibilities if you are unable to save for a 20% down payment, such as conventional loans that demand as little as a 3% down payment or mortgages from the Federal Housing Administration that don't require a down payment. Through state, local, or charitable programs, you could also be able to receive assistance with your down payment and closing fees.

What Is the Maximum Amount You Can Spend on Bills?

A crucial component of the computation is your monthly earnings. This covers your income from work, investments, and other sources of funding. Together with your anticipated mortgage payment and property taxes, it also includes regular debt obligations such as credit card bills, auto loans, and student loans.

To help with your down payment, you might be eligible to receive gift money from family members; however, the guidelines for gift money differ depending on the lender and mortgage plan. Your loan amount and monthly payments will decrease with a larger down payment. It also implies that your mortgage payment will not increase annually due to the avoidance of mortgage insurance.

Recommended Reading:

The Advantages of Loan Refinancing at High Interest Rates →

Stay Updated

Actionable growth insights, once a week. No fluff, no spam—unsubscribe anytime.

You May Like

Selecting the Ideal House for Your Requirements as a First-Time Purchaser

06/10/2025

Current Trends and News on Mortgage Rates

06/11/2025

A Guide to Comprehending Your Taxes and Filing Your Return

06/16/2025

How Much Do Personal Loans Cost?

06/09/2025

Auto Loans: Things to Take into Account While Financing a New or Used Vehicle

06/10/2025

Disability Benefits for Independent Contractors

08/19/2025

Getting Ready for College? Employ a student loan estimator.

08/23/2025

Bankruptcy Law: A Financial Recuperation Tool

08/05/2025

The Advantages of Loan Refinancing at High Interest Rates

07/08/2025

Loan Calculators' Restrictions

08/26/2025

Disability Insurance: Safeguarding Your Income in the Event of an Unexpected Situation

08/03/2025

How Much Is Enough to Put Down on a Mortgage Loan?

08/06/2025

Keeping Up With Legal Matters

09/04/2025

Defending Your Property Against Theft: Advice From Renters Insurance

06/19/2025

Emergency Money: When to Take into Account a Personal Loan

09/04/2025

Senior Health Insurance: Medicare and Beyond

08/14/2025

Recognizing Various Mortgage Types

06/12/2025

Trends and Innovations for Debt Consolidation Loans in the Future

06/26/2025

What You Need to Know About Renters Insurance and Subletting

07/19/2025

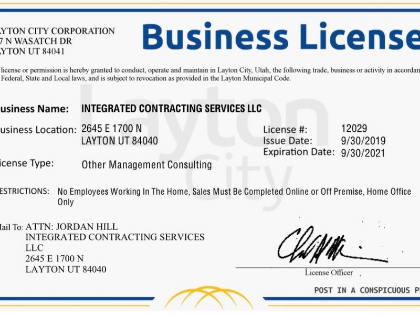

The Value of Obtaining the Appropriate Licenses and Permits for Your Business

06/19/2025

Factors in the Economy That Impact Mortgage Rates

06/05/2025

Selecting the Ideal Health Insurance Program for Your Needs

06/26/2025

Innovations and Trends in Refinancing in the Future

07/02/2025

Red Flags from Mortgage Lenders: Things to Look Out for

06/08/2025

Comments

HarborCatalyst · 08/19/2025

Fosters iterative trust accrual.

PineChronicle · 07/23/2025

This reframes a lot.

EchoHarbor · 08/28/2025

Subtle but impactful.