Defending Your Property Against Theft: Advice From Renters Insurance

Advertisement

For a variety of reasons, many people decide to rent their homes rather than buy them. Renting typically results in lower costs for upkeep, repairs, and property taxes, but it also excludes your personal goods from homeowner's insurance coverage.

Thankfully, there are a few steps you can do to guard your belongings and stop theft.

Shut the Doors

It's likely that you've heard the proverb "to lock or not to lock," and regardless of your stance on door locks or lack thereof, the truth is that criminals enjoy breaking into unlocked homes. It gives criminals the freedom to take your belongings and confidential data without worrying about getting discovered.

Fortunately, a lot of Americans remember to change the locks when they leave the house; those who live in apartments are more likely to remember to do this small but sensible safety measure. Following closely after were single-family homes, town homes, and residents of gated communities, with about 70% of respondents locking their doors.

The fact is that, whatever your lifestyle, it is easy to forget to lock the doors when you are rushing to grab groceries or pick up the kids. Why not make it a habit to turn the lock—it just takes a few seconds? If you don't want to deal with the inconvenience of losing or replacing your gadgets and the crucial data saved on them, the peace of mind is well worth the expense.

Safeguard your devices.

A mobile device or laptop is a prime target for burglars. They can result in the loss of sensitive client and company data, are costly to replace, and contain important information. Devices that have been reported as stolen by some large cell carriers will be "brick," decreasing their value and making them more difficult for criminals to utilize.

Never leave valuables such as cameras, electronics, or other items on train seats or in dining establishments. As much as possible, carry them with you or store them away. Make sure to lock them up or get someone to monitor them if you have to go away from them for a brief period of time (to use the restroom, get a napkin at Starbucks, answer the phone, etc.).

Replacement cost coverage (RCV) for lost, stolen, or damaged personal goods within your house is provided by Lemonade Renters Insurance. Click here to find out more! Or begin your Lemonade coverage right away. It's quick and simple. To activate your policy, we'll text you a code.

Keep an eye on your car.

Even while you're not home, renters insurance can help shield your possessions against theft and other calamities. In the event that a covered incident, such as a fire or tornado, renders your rental uninhabitable, it may also cover your additional living costs.

Make a home inventory and estimate the worth of your belongings to find out how much personal property coverage you need on your policy. By doing this, you'll be able to maximize the coverage your policy offers.

If you keep business supplies at your house or run a home business, you might want to consider including an endorsement in your policy that protects this property. Remember that most regular personal property coverage on a renters or homeowners policy does not cover motorized equipment or business merchandise.

Make a list of items.

Determining what has vanished can be exceedingly challenging, regardless of whether the missing objects are stolen or damaged due to a fire or natural disaster. Having an inventory list for your house or rental is beneficial, but it becomes much more crucial when it comes to making an insurance claim.

Making an inventory of everything in your house or apartment can assist you in keeping track of it and will demonstrate the condition of the items when you moved in. Additionally, this will greatly simplify the process of checking out at the end of your tenancy.

A good rental inventory lists every item in the home or apartment along with its value, location, and a detailed description that includes the brand, model, and serial number, if relevant. To prevent it from being stolen, the inventory needs to be kept in a secure location. Taking pictures or videos of your belongings is also a smart idea, especially the more costly ones like electronics, jewelry, and furniture.

Recommended Reading:

Estate planning and charitable giving →

Stay Updated

Actionable growth insights, once a week. No fluff, no spam—unsubscribe anytime.

You May Like

Keeping Up With Legal Matters

07/11/2025

Factors in the Economy That Impact Mortgage Rates

06/12/2025

Knowing the Differences Between Medicaid and Long-Term Care Insurance

07/18/2025

Trends and Innovations for Debt Consolidation Loans in the Future

06/20/2025

The Price of a Mortgage Refinancing

07/04/2025

Becoming Eligible for a Mortgage as a New Purchaser

07/04/2025

How Much Do Personal Loans Cost?

06/10/2025

Senior Health Insurance: Medicare and Beyond

09/03/2025

Estate planning and charitable giving

09/02/2025

Where to Apply for a Car Loan

06/09/2025

Recognizing Various Mortgage Types

08/22/2025

Plea Agreements and Penalties

08/06/2025

Chronic Conditions and Disability Insurance: What You Should Know

09/03/2025

Bankruptcy Law: A Financial Recuperation Tool

08/28/2025

The Value of Intellectual Property to Both Individuals and Businesses

07/17/2025

A Guide to Comprehending Your Taxes and Filing Your Return

07/25/2025

Selecting the Ideal House for Your Requirements as a First-Time Purchaser

07/09/2025

Disability Benefits for Independent Contractors

09/01/2025

Your online shopping rights

07/01/2025

Emergency Money: When to Take into Account a Personal Loan

07/16/2025

Auto Loans: Things to Take into Account While Financing a New or Used Vehicle

08/11/2025

Innovations and Trends in Refinancing in the Future

07/23/2025

Getting Ready for College? Employ a student loan estimator.

08/17/2025

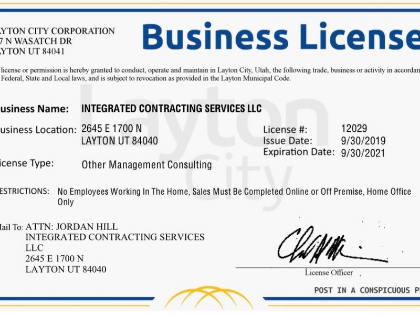

The Value of Obtaining the Appropriate Licenses and Permits for Your Business

06/06/2025

Comments

LanternVector · 07/27/2025

Balanced optimism vs. realism.

DuneNavigator · 07/21/2025

This invites debate—who disagrees?

KineticHarbor · 08/18/2025

Maintains narrative altitude control.