Becoming Eligible for a Mortgage as a New Purchaser

Advertisement

Upon purchasing your first home, you become eligible for a variety of loan options that help with down payments and mortgages. Tax deductions for first-time homebuyers are another thing to think about.

Even if you have previously owned real estate, you can still be eligible for these loans, depending on your circumstances. This is due to the fact that the first-time buyer definition is more flexible than you may imagine.

Credit Rating

One factor that can significantly affect your capacity to buy a house is your credit score. This three-digit figure, also referred to as your FICO score, shows how successfully you've paid off your debts over the previous seven to ten years.

Different standards are used by mortgage lenders to identify first-time applicants. For instance, if you haven't bought a home in the previous three years, certain lenders will only classify you as a first-time buyer. Some provide first-time buyers with exclusive mortgage plans that include reduced interest rates and other benefits. Among these are down payment assistance programs (DPA), which offer grants or loans with low to no interest that don't need to be paid back.

Fulfilling income standards is an additional means of becoming eligible as a first-time buyer. The income restrictions on many mortgage programs are determined by your family size and the area in which you are purchasing. Some demand that you meet specified requirements regarding your debt-to-income ratio or credit score.

Ratio of Debt to Income

When assessing mortgage applications, one of the most crucial elements that lenders take into account is the debt-to-income ratio, or DTI. This ratio assists lenders in determining if you can afford the new property you wish to purchase by comparing your monthly debt payments to your gross monthly income.

When evaluating mortgage applications, lenders usually consider two types of DTIs: front-end and back-end. The front-end ratio takes into account all of your possible housing costs, including the principal and interest on your mortgage, property taxes, homeowners insurance premiums, and homeowners association dues, if any.

Add together all of your monthly debt payments, including those for credit card debt, vehicle loans, and school loans, then divide the total by your gross monthly income to find your DTI. You can use this value to find your DTI, which is given as a percentage. A lower DTI might increase your chances of getting approved for loans, including mortgages. By employing a debt payback plan such as the snowball or avalanche approach, you can lower your debt-to-income ratio.

Initial Payment

When purchasing a home, the amount of the down payment you make usually influences the terms and interest rate of your mortgage. Large down payments are typically preferred by lenders since they lower the financial risk associated with their loans and hasten the equity-building process for borrowers. However, first-time buyers and those with limited resources may find it challenging to save for a down payment.

Thankfully, first-time buyers can receive support from state and municipal down payment assistance programs. Usually, these programs provide grants or low-interest loans that help with closing fees and a portion of the down payment. Candidates must fulfill the minimal prerequisites for qualifying, which include having good credit and proof of income.

For buyers who make less than 80% of the area median income, the Fannie Mae HomePath Ready Buyer program offers a conventional loan with just a 3% down payment. Additional possibilities for first-time buyers include the VA and FHA financing programs. The first-time homeowner tax deduction is currently in effect through 2023.

Final Expenses

Closing costs can total between 3% and 6% of the sale price of a home. They are fees that are incurred at the conclusion of the mortgage process. They consist of processing and document fees, underwriting costs, and legal fees. Closing costs are normally covered by the buyer, but they may occasionally be negotiated (apart from government-assessed costs like property and transfer taxes).

For first-time buyers, several mortgage lenders provide exclusive discounts on closing expenses. They might, for instance, reduce the cost of title insurance or waive some loan application and processing expenses. Programs for down payment help are also available to first-time purchasers. Typically, these are grants, although they can also be low- or no-interest loans.

Although they are not eligible for many programs branded as first-time homeowner programs, repeat buyers can nevertheless qualify for some types of mortgages. Certain programs have income restrictions in addition to other requirements, such as not having owned a property over the previous three years.

Recommended Reading:

Taking a Personal Injury Case to Trial →

Stay Updated

Actionable growth insights, once a week. No fluff, no spam—unsubscribe anytime.

You May Like

The Price of a Mortgage Refinancing

07/16/2025

Defending Your Property Against Theft: Advice From Renters Insurance

08/13/2025

Disability Benefits for Independent Contractors

06/26/2025

Selecting the Ideal Health Insurance Program for Your Needs

06/17/2025

Senior Health Insurance: Medicare and Beyond

07/23/2025

Auto Loans: Things to Take into Account While Financing a New or Used Vehicle

08/16/2025

Red Flags from Mortgage Lenders: Things to Look Out for

08/27/2025

Chronic Conditions and Disability Insurance: What You Should Know

09/04/2025

Your online shopping rights

06/21/2025

Factors in the Economy That Impact Mortgage Rates

08/06/2025

Disability Insurance: Safeguarding Your Income in the Event of an Unexpected Situation

06/12/2025

Getting Ready for College? Employ a student loan estimator.

08/16/2025

The Value of Intellectual Property to Both Individuals and Businesses

08/08/2025

Loan Calculators' Restrictions

07/27/2025

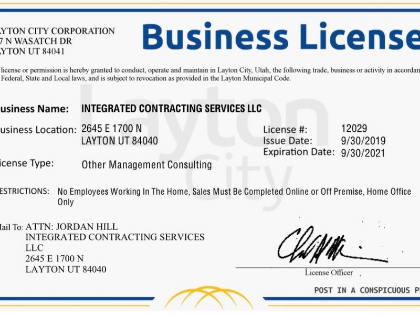

The Value of Obtaining the Appropriate Licenses and Permits for Your Business

07/04/2025

A Guide to Comprehending Your Taxes and Filing Your Return

07/13/2025

Current Trends and News on Mortgage Rates

06/30/2025

How Much Do Personal Loans Cost?

08/08/2025

Knowing the Differences Between Medicaid and Long-Term Care Insurance

08/18/2025

Innovations and Trends in Refinancing in the Future

07/05/2025

Becoming Eligible for a Mortgage as a New Purchaser

07/18/2025

Trends and Innovations for Debt Consolidation Loans in the Future

06/17/2025

Selecting the Ideal House for Your Requirements as a First-Time Purchaser

08/02/2025

The Advantages of Loan Refinancing at High Interest Rates

07/06/2025

Comments

BinaryQuill · 07/24/2025

Simplifies cross-functional orchestration.

StellarSpindle · 06/13/2025

Good raw material for FAQs.

LunarGlyph · 08/27/2025

Maintains adaptive clarity.

SpiralEnvoy · 07/13/2025

Could fuel a metrics dashboard.

PrismVoyager · 08/19/2025

Facilitates mental model sync.