The Advantages of Loan Refinancing at High Interest Rates

Advertisement

One of the most crucial steps you can take to improve your financial situation is refinancing. But it's critical to comprehend the advantages and disadvantages of refinancing.

Refinancing offers several advantages, chief among them being a shorter loan term, reduced monthly payments, and interest cost savings. The following are some of the most typical explanations for thinking about refinancing your high-interest debts:.

1. Reduced Monthly Instalments

Refinancing has several advantages, one of which is a reduction in monthly expenses. You may be able to obtain a cheaper interest rate and even adjust the length of your payment term by refinancing your previous loan. This is a particularly well-liked choice when mortgage rates go down.

However, before you decide to refinance, make sure you take the entire cost of your loan into account. For instance, if you wish to prolong your loan term to reduce your payments since you're almost at the end of your repayment term, keep in mind that doing so would result in higher long-term interest costs.

Furthermore, keep in mind that applying for a new loan may result in a credit check, which could momentarily drop your score. However, over time, regular, on-time payments might aid in the restoration of your credit score. Furthermore, a lot of lenders charge costs for a new loan, which might cancel out any potential savings from refinancing.

2. Combine your loans.

Your payments can be made easier with a debt consolidation refinance, which combines many high-interest loans into a single mortgage payment. In addition to lowering your chance of skipping a credit card or personal loan payment, that can help you manage your money more easily. Because mortgage rates are usually lower than credit card rates, it can also result in interest cost savings.

You can wind up paying more in interest than you would have otherwise if you consolidate your debt and then keep using the credit cards you paid off. You run the danger of temporarily harming your credit score as well.

If you think you won't be able to repay the new loan or accumulate more debt in the future, it's better to avoid combining your debt. To be eligible for a better rate, you should focus on improving your income and credit. If you want to apply for a debt consolidation loan, it's critical to pay off the loan with the highest interest rate first.

3. Raise your credit rating.

The good news is that, if you are eligible for a reduced interest rate and have a sound financial plan, refinancing your personal loan will most likely improve your credit score. This is so that your lenders will notice that you have a solid credit history as the original loan will be closed and replaced with a new account. Actually, the length of your credit history accounts for fifteen percent of your credit score.

While the credit inquiries related to qualifying for a new loan may temporarily lower your credit score, if you continue to make on-time payments, it should eventually rise. This is particularly true if you pay off debt with your new loan; this will help you establish a track record of on-time payments.

It's also important to remember that when you refinance, the older accounts on your credit report will be canceled, potentially lowering the average age of your accounts. Long-term savings from lower interest rates should, however, more than balance this effect.

4. Release money.

Refinancing to release equity from your property and obtain cash from your equity may be beneficial, depending on your creditworthiness and financial objectives. You may be able to avoid paying hundreds of dollars in interest by using this kind of debt consolidation loan, which frequently has rates lower than credit cards and personal loans.

By consolidating several loans into a single payment, refinancing might also make it easier for you to pay off debt. It can also lower your credit utilization ratio, which raises your credit score.

If you're thinking about refinancing with a cash out, make sure you thoroughly investigate lenders and evaluate terms, fees, and rates. Additionally, confirm that your current mortgage does not contain a prepayment penalty, since this could offset any savings from refinancing. Other funding options can be more appropriate if you are unable to qualify for refinancing or if you do not want to take on additional debt. A second mortgage or home equity loans and lines of credit (HELOCs) are some of these choices.

Recommended Reading:

Trends and Innovations for Debt Consolidation Loans in the Future →

Stay Updated

Actionable growth insights, once a week. No fluff, no spam—unsubscribe anytime.

You May Like

Disability Benefits for Independent Contractors

09/02/2025

Senior Health Insurance: Medicare and Beyond

08/18/2025

Comparing Liability and Collision: Knowing Your Options for Auto Insurance

07/18/2025

Red Flags from Mortgage Lenders: Things to Look Out for

07/17/2025

Your online shopping rights

07/24/2025

The Advantages of Loan Refinancing at High Interest Rates

07/24/2025

Where to Apply for a Car Loan

08/02/2025

Becoming Eligible for a Mortgage as a New Purchaser

08/04/2025

Defending Your Property Against Theft: Advice From Renters Insurance

07/29/2025

Getting Ready for College? Employ a student loan estimator.

08/02/2025

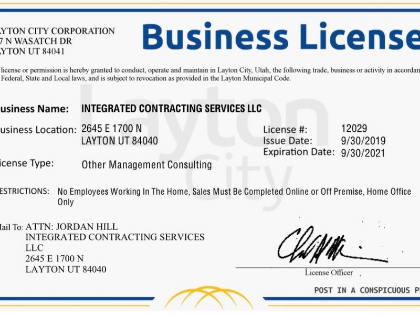

The Value of Obtaining the Appropriate Licenses and Permits for Your Business

07/13/2025

Estate planning and charitable giving

08/08/2025

Emergency Money: When to Take into Account a Personal Loan

06/09/2025

Selecting the Ideal Health Insurance Program for Your Needs

08/15/2025

Selecting the Ideal House for Your Requirements as a First-Time Purchaser

07/21/2025

Recognizing Various Mortgage Types

09/01/2025

Bankruptcy Law: A Financial Recuperation Tool

08/02/2025

The Value of Intellectual Property to Both Individuals and Businesses

07/02/2025

Auto Loans: Things to Take into Account While Financing a New or Used Vehicle

06/14/2025

Loan Calculators' Restrictions

06/06/2025

Factors in the Economy That Impact Mortgage Rates

07/21/2025

Innovations and Trends in Refinancing in the Future

08/05/2025

The Price of a Mortgage Refinancing

06/24/2025

Plea Agreements and Penalties

07/06/2025

Comments

QuantumBadger · 08/04/2025

Promotes intentional tradeoffs.