How Much Do Personal Loans Cost?

Advertisement

Being mindful of possible costs is crucial while looking for personal loans. These could consist of late fees, application fees, and origination fees.

You should think about whether a lender charges credit insurance or prepayment penalties and whether they offer a repayment term that allows you to choose a deadline for paying off your debt, in addition to the interest rate.

1. Rate of Interest

The main expense related to personal loans is interest rates. They can be determined by your income, credit score, and other variables, and they can be computed using one of three methods: simple, compound, or add-on.

Lenders take into account your existing debt as well as any secured loans, such as mortgages or auto loans. To ascertain whether you have managed previous debt responsibly, they also take into account your credit history.

Although it's not necessary, having excellent credit is helpful when applying for a low-rate personal loan. Charge cheaper rates than banks, online lenders and certain credit unions specialize in working with consumers with fair or bad credit.

The location of your residence and the underwriting standards of the lender are two other variables that could affect your personal loan rate. For instance, some internet lenders use the borrower's job and educational background to gauge their earning potential and creditworthiness. Others determine your rate and assess your risk based on your debt-to-income ratio (DTI).

2. Charges

Interest, which lenders tack on to the principal amount you borrow for the duration of the loan, is the main expense related to personal loans. Lenders may also charge extra for things like document processing or an origination fee to begin your loan. If you pay a lender beyond the deadline, some of them may additionally assess late penalties.

When selecting a personal loan, it is crucial to evaluate several lenders because the interest rate and other costs associated with the loan add up to the overall cost of borrowing. A higher credit score can lead to cheaper rates, which can save you money over the course of your loan. Therefore, you should also take it into account. To make sure you can afford the debt, it's also crucial to utilize a personal loan calculator to calculate your monthly payments and overall interest costs. A personal loan calculator is available on the websites of numerous lenders.

3. Schedule of Payment

Lenders provide you with an estimate for a personal loan that includes details about the interest rate and monthly payment. The monthly payment covers both the principal and interest that have accumulated on your loan.

Your credit score, the lender, and the amount you borrow all affect the interest rate on your personal loan. For instance, you are more likely to be eligible for a lender's lowest stated rates if your credit score is better.

To get the best personal loan rate for your needs, shop around with a number of lenders since they utilize credit ratings to determine what features, quantities, and interest rates to provide. Seek out lenders who don't charge origination or other fees when you're browsing. These lenders can simplify loan comparisons and help borrowers grasp their overall borrowing costs. Furthermore, internet lenders frequently give you a detailed summary of all the costs involved, including interest.

4. APR

Although personal loans have higher interest rates than credit cards, it's still vital to consider the advantages over the disadvantages before applying for one. The most important component is your credit score, which affects the total cost of the loan during its length.

APR, which accounts for both fees and interest, represents the true cost of borrowing. Compared to concentrating only on the interest rate—which is sometimes marketed on a monthly basis rather than an annual one—it is more accurate.

APRs differ significantly between lenders as well and may be higher or lower based on your specific circumstances. This is because, unlike huge banks, which might give preference to their current, well-credited customers, internet lenders typically concentrate on a small number of credit segments (such as fair- and bad-credit borrowers) and price appropriately. Therefore, in order to make an informed choice regarding your personal loan possibilities, you should compare APRs. When comparing lenders—online and offline—this is particularly crucial.

Recommended Reading:

Where to Apply for a Car Loan →

Stay Updated

Actionable growth insights, once a week. No fluff, no spam—unsubscribe anytime.

You May Like

Loan Calculators' Restrictions

08/26/2025

Recognizing Various Mortgage Types

07/25/2025

Selecting the Ideal House for Your Requirements as a First-Time Purchaser

06/16/2025

Plea Agreements and Penalties

06/30/2025

Taking a Personal Injury Case to Trial

08/02/2025

How Much Is Enough to Put Down on a Mortgage Loan?

09/01/2025

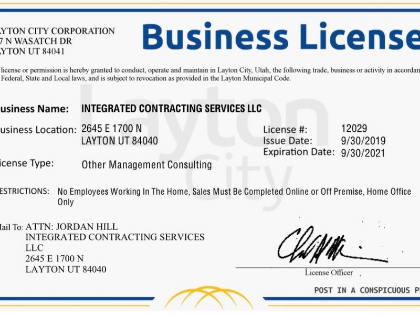

The Value of Obtaining the Appropriate Licenses and Permits for Your Business

09/02/2025

Disability Benefits for Independent Contractors

08/02/2025

Current Trends and News on Mortgage Rates

08/12/2025

Defending Your Property Against Theft: Advice From Renters Insurance

07/24/2025

Your online shopping rights

06/27/2025

Senior Health Insurance: Medicare and Beyond

07/23/2025

How Much Do Personal Loans Cost?

07/29/2025

Factors in the Economy That Impact Mortgage Rates

08/20/2025

The Price of a Mortgage Refinancing

07/13/2025

The Value of Intellectual Property to Both Individuals and Businesses

07/15/2025

A Guide to Comprehending Your Taxes and Filing Your Return

07/29/2025

Becoming Eligible for a Mortgage as a New Purchaser

07/30/2025

Where to Apply for a Car Loan

08/04/2025

Keeping Up With Legal Matters

06/24/2025

Comparing Liability and Collision: Knowing Your Options for Auto Insurance

08/13/2025

Auto Loans: Things to Take into Account While Financing a New or Used Vehicle

08/13/2025

Disability Insurance: Safeguarding Your Income in the Event of an Unexpected Situation

06/21/2025

Red Flags from Mortgage Lenders: Things to Look Out for

08/21/2025

Comments

DriftParagon · 07/28/2025

Provokes useful discomfort.

ArcticVector · 07/02/2025

Quietly powerful. What’s the core takeaway?