The Price of a Mortgage Refinancing

Advertisement

Benefits from refinancing your mortgage include access to home equity, shorter loan terms, and lower interest rates. It might, however, come with expenses.

Lender fees and other third-party expenses associated with refinancing your mortgage are referred to as closing costs. A higher long-term interest rate will result from rolling over the costs into your loan balance, since some lenders claim "no closing cost" refinances.

1. Final Expenses

Closing expenses apply to refinances just like they do to new mortgage loans. These costs typically represent between 2% and 6% of the loan balance, according to Freddie Mac.

These expenses consist of application, origination, and appraisal costs for loans. In addition, there are fees associated with updating ownership of the property, credit report updates, and recording.

A way to lower refinance expenses is to shop around and contrast lenders. Asking each lender to send you a loan estimate can give you an idea of what you might pay, as different lenders have varying costs and loan programs. Furthermore, you might be able to work out a deal with the lender or choose a refinance with no closing costs. However, these choices are only worthwhile if you intend to maintain your mortgage long enough to pay off the initial costs.

2. Lender charges

You pay back your lender for any costs associated with the mortgage when you refinance. These could include fees for credit reports, appraisals, and loan originations. In order to process the paperwork related to the new mortgage loan, some lenders additionally demand a recording fee.

You might be able to reduce your monthly payments, pay off your loan sooner, and increase equity faster by refinancing for a shorter term. But throughout the course of your loan, interest costs could increase.

Certain lenders provide refinance options with no closing costs. Although they can save you money up front, because of rising interest rates, the overall cost of the refinance may increase over time. When considering refinance choices, take care to evaluate yearly percentage rates.

3. Evaluation charges

To determine the value of your house, mortgage lenders conduct an appraisal. This reduces the amount you can borrow and guards against overlending. Refinances, including cash-out refinancing to access home equity or rate and term refinancing, which reworks your loan into a shorter or longer timeframe, may require an assessment.

Refinancing at no closing costs is something that certain mortgage lenders provide, and it can drastically lower your total expenditures. However, the interest rates on these loans are typically higher, so you should calculate the whole cost to be sure you'll save money over time. Estimate your refinance costs using a refinance calculator, then weigh them against the monthly savings you would receive from a new, lower-rate mortgage. If the calculations add up, refinancing can be a wise financial decision.

4. Fees for Credit Reports

Getting a new loan to replace your current one is known as mortgage refinancing. Refinancing for a shorter term, a lower interest rate, or to access your home equity are your options. Your lender examines your credit when you apply for a refinance to make sure you can repay the loan and have sufficient income and savings to qualify for it.

Your credit score may momentarily drop as a result of a refinance due to the additional debt and several aggressive inquiries from lenders. However, when you demonstrate that you can responsibly handle your additional debt, your score will rise.

Generally speaking, refinancing is only financially advantageous if your new mortgage reduces your rate, lowers your monthly payment, or takes advantage of your home equity. If not, you can wind up paying more in fees than you ultimately save.

5. Insurance for Mortgages

Many borrowers refinance in order to lower their interest rate, extend the term of their loan, or utilize home equity for other uses, such as debt consolidation. Costs associated with refinancing can mount up quickly, particularly if the new mortgage rate isn't low enough to cover closing costs and other charges.

Refinancing may be worthwhile if interest rates are lower now than they were when you took out your initial mortgage. However, you should sum up all of the refinancing expenses and compare them to your monthly savings to determine when your refinance will break even. A calculator is another tool you can use to weigh your alternatives. It's crucial to take into account how long you intend to remain in your house. It might not make sense to pay to refinance now if you plan to move in a few years.

Recommended Reading:

Keeping Up With Legal Matters →

Stay Updated

Actionable growth insights, once a week. No fluff, no spam—unsubscribe anytime.

You May Like

Comparing Liability and Collision: Knowing Your Options for Auto Insurance

07/03/2025

The Value of Intellectual Property to Both Individuals and Businesses

08/04/2025

What You Need to Know About Renters Insurance and Subletting

06/09/2025

Selecting the Ideal House for Your Requirements as a First-Time Purchaser

07/20/2025

Knowing the Differences Between Medicaid and Long-Term Care Insurance

07/06/2025

How Much Do Personal Loans Cost?

08/24/2025

Disability Insurance: Safeguarding Your Income in the Event of an Unexpected Situation

08/16/2025

Plea Agreements and Penalties

09/04/2025

Auto Loans: Things to Take into Account While Financing a New or Used Vehicle

06/26/2025

Keeping Up With Legal Matters

07/16/2025

Defending Your Property Against Theft: Advice From Renters Insurance

08/22/2025

Getting Ready for College? Employ a student loan estimator.

08/19/2025

Current Trends and News on Mortgage Rates

06/09/2025

Estate planning and charitable giving

06/05/2025

The Price of a Mortgage Refinancing

08/02/2025

Emergency Money: When to Take into Account a Personal Loan

07/02/2025

The Advantages of Loan Refinancing at High Interest Rates

08/31/2025

A Guide to Comprehending Your Taxes and Filing Your Return

06/09/2025

Your online shopping rights

08/04/2025

Loan Calculators' Restrictions

08/03/2025

Selecting the Ideal Health Insurance Program for Your Needs

08/02/2025

How Much Is Enough to Put Down on a Mortgage Loan?

07/16/2025

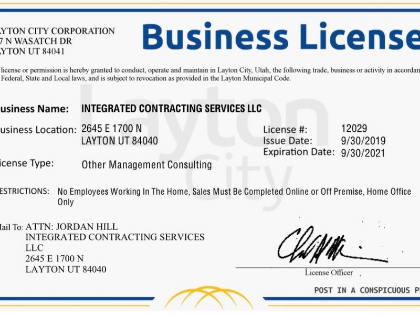

The Value of Obtaining the Appropriate Licenses and Permits for Your Business

08/03/2025

Where to Apply for a Car Loan

07/31/2025

Comments

EchoMoraine · 07/13/2025

Feels universally adaptable.

GlacierCourier · 06/24/2025

Compact and sharp. Expand a sequel?

IndigoCoyote · 07/20/2025

Compact and sharp. Expand a sequel?

StellarTactician · 07/13/2025

Promotes reversible exploration.

LanternWarden · 07/27/2025

Zero wasted ornament.