Trends and Innovations for Debt Consolidation Loans in the Future

Multiple outstanding debts are consolidated into a single loan with a reduced interest rate and monthly payment through debt consolidation loans. They can pay off other unsecured debt, such as personal loans, but they work best on credit card debt.

When debt is repaid on time, debt consolidation can lower interest rates and payments while also boosting credit scores. It's crucial to evaluate appropriateness in light of each person's unique financial situation and objectives, though.

1. Financial technology

The industry jargon for the businesses and technologies that run our financial operations is fintech. Payment processors such as Klarna, which provides financing to customers for purchases made online from big retailers, and Stripe, which is estimated to be worth $95 billion, are part of this expansive industry. Fintech also extends into more specialized businesses, like investtech (like Acorns), insurtech (like mobile-first insurer Next Insurance), and wealthtech (apps like Wealthsimple).

Debt consolidation can save interest costs, raise credit ratings, and streamline your bill-paying process when utilized properly. However, you must be aware of when it makes sense as well as what to avoid. Here are three situations in which you can benefit from a debt consolidation loan:

2. Information

Reducing debt can improve credit ratings, decrease credit card balances, and lessen stress. However, before you take out a debt consolidation loan, it's crucial to understand how it can affect your credit.

Generally speaking, debt consolidation loans are unsecured personal loans that are intended to settle high-interest debts, such as credit card balances. Typically, they are paid back over a period of one to seven years in fixed amounts.

You may be able to reduce your interest costs and handle several monthly payments with the assistance of a debt consolidation loan. Nevertheless, not everyone should use it. Seek out a nonprofit credit counselor before pursuing this kind of financial solution. They can offer professional advice on managing debt, creating a budget, and creating a unique plan to help you get your finances back on track.

3. AI

Netflix's suggestions and Apple's Siri both use narrow artificial intelligence (AI), depending on pre-established patterns to react to certain user queries. Other narrow AI systems include automated customer service bots and generative models like ChatGPT and Dall-E 3, which can generate text or graphics depending on input.

More potent AI is employed in a range of creative applications, such as music and visual arts, as well as in self-driving cars and fraud detection. True artificial general intelligence (AGI), on the other hand, is still a long way off since it would require a machine to be able to comprehend and carry out a wide range of tasks on its own using its experience.

In the end, debt consolidation loans seem to function as promised and assist borrowers in managing their debt, which is their intended purpose. However, it's crucial to look at the entire picture before submitting an application.

4. Big data

One kind of personal loan is a debt consolidation loan. Borrowers may benefit from cheaper interest rates, fewer monthly fees, and simpler debt payments. It does not, however, address the fundamental difficulties that caused their debt troubles.

Most respondents anticipated that after paying back their debt consolidation loan, they would start accruing debt once more. In order to avoid future debt buildup, long-term financial planning, reducing wasteful spending, and setting up an emergency fund were the most recommended strategies.

The term "big data" proved difficult to define, with some researchers pointing to a number of qualities such as "several Vs," veracity, value, and variability, in addition to exhaustivity and extensionality. A vast number of sources, speed, variety, and complexity are further characteristics. Analytics using big data can highlight patterns and trends that might otherwise go unnoticed.

5. Internet-Based Promotion

A debt consolidation loan reduces interest rates by combining several loans into one. With only one monthly payment, it can save costs, streamline payments, and potentially hasten debt repayment.

For customers with good credit, the finest debt consolidation loans have low interest rates. Some, nevertheless, might not be the best choice for everyone and have rates greater than those on your credit cards.

If you use a debt consolidation loan to pay off credit card debt and minimize the amount of outstanding debt that shows up on your credit report, your credit score will rise. Additionally, it can raise your credit usage ratio, which is calculated by dividing your current sum due by the entire amount available. However, if you apply for a new debt consolidation loan, your credit score may be momentarily impacted by a hard credit inquiry.

Stay Updated

Actionable growth insights, once a week. No fluff, no spam—unsubscribe anytime.

You May Like

Defending Your Property Against Theft: Advice From Renters Insurance

08/26/2025

Chronic Conditions and Disability Insurance: What You Should Know

07/11/2025

Auto Loans: Things to Take into Account While Financing a New or Used Vehicle

06/25/2025

The Price of a Mortgage Refinancing

06/10/2025

Trends and Innovations for Debt Consolidation Loans in the Future

06/18/2025

Keeping Up With Legal Matters

06/24/2025

The Advantages of Loan Refinancing at High Interest Rates

08/06/2025

Disability Benefits for Independent Contractors

07/20/2025

Recognizing Various Mortgage Types

08/14/2025

How Much Is Enough to Put Down on a Mortgage Loan?

08/27/2025

Emergency Money: When to Take into Account a Personal Loan

08/04/2025

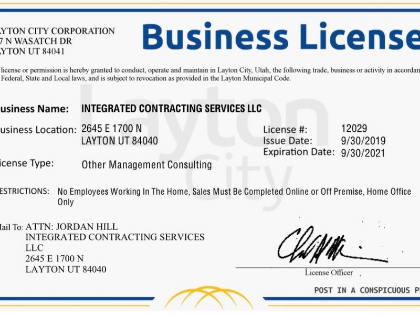

The Value of Obtaining the Appropriate Licenses and Permits for Your Business

06/16/2025

Becoming Eligible for a Mortgage as a New Purchaser

08/01/2025

Your online shopping rights

09/02/2025

Innovations and Trends in Refinancing in the Future

07/28/2025

Plea Agreements and Penalties

07/15/2025

Taking a Personal Injury Case to Trial

06/24/2025

What You Need to Know About Renters Insurance and Subletting

07/05/2025

Where to Apply for a Car Loan

06/14/2025

Factors in the Economy That Impact Mortgage Rates

07/06/2025

Getting Ready for College? Employ a student loan estimator.

06/06/2025

Selecting the Ideal Health Insurance Program for Your Needs

07/16/2025

The Value of Intellectual Property to Both Individuals and Businesses

06/27/2025

How Much Do Personal Loans Cost?

08/01/2025

Comments

QuantumNomad · 09/04/2025

Adaptive scaffolding in action.

VelvetTelemetry · 08/15/2025

Quietly de-bloats narrative.

PrismVoyager · 06/24/2025

Leaves bias inspection space.

IndigoSpin · 06/28/2025

Thinking in layers now.