Innovations and Trends in Refinancing in the Future

Refinancing is the process of modifying an existing credit arrangement, like a mortgage or loan. Refinancing is usually done to better one's financial status, take advantage of cost-saving measures, or accomplish other financial objectives.

Lender incentives and market competitiveness drive the refinancing industry's growth. Borrowers must, however, make sure that they are assembling the appropriate data base to aid in their refinancing process.

1. The use of artificial intelligence

Artificial Intelligence has begun to change the mortgage market. It is an effective tool for lenders because of its capacity to simplify procedures and lower error rates.

In a recent poll conducted by STRATMOR, responding lenders ranked customer service, document reading and classification, and marketing to customers as their top three uses of AI.

AI-powered systems can also scan massive datasets for market trends and automate repetitive processes. They also aid in the detection of fraud and possible risk factors. AI-driven optical character recognition (OCR) systems, for instance, are able to scan, identify, and highlight irregularities in papers, such as fictitious income information or questionable transactions.

Furthermore, borrower profiles and creditworthiness can be more precisely evaluated by AI algorithms. In the end, this helps lenders make better lending decisions and reduces credit risk. Additionally, it assists them in keeping up with shifting laws and industry trends.

2. Customer-focused tactics

In the refinancing market, borrowers exchange their current loans or debt obligations for new ones with better conditions. Refinance possibilities can reveal hidden value inside financial arrangements, whether the borrower is wanting to lower their mortgage expenses or the business is looking for more flexibility with their cash flow.

However, in order to get the most out of refinancing, companies need to adopt customer-focused tactics that complement their overarching goals. Beyond conventional customer service measures like CSAT, customer centricity focuses on gaining a deeper understanding of customers. This can involve learning how people prefer to be communicated with, what kinds of experiences they anticipate, and how their existing offerings fit into their lifestyles.

A lender can enhance user experience by offering borrowers mobile applications or web platforms for uploading documents, monitoring loan status, and communicating with lenders. Consequently, this enhances client happiness and raises the possibility of repeat business. This ultimately results in a more robust revenue foundation for the lender.

3. Environmentally Sustainable Choices

Mortgage lenders and customers are embracing eco-friendly financing options to lessen their carbon impact in response to growing environmental concern. These green financial solutions offer tax breaks and reduced utility expenses to entice homeowners to make energy-efficient home modifications like adding solar panels and switching to a programmable thermostat.

Innovative technologies that incorporate artificial intelligence and data analytics into mortgage refinancing procedures enable these environmentally friendly financing choices. To provide the best refinance loan alternatives, AI-powered mortgage refinance systems, for instance, can examine a borrower's credit score and mortgage history.

In addition, in order to evaluate a borrower's creditworthiness in ways other than traditional credit ratings, mortgage lenders are looking into alternative data sources. Social media accounts, rental payment information, and start-ups that compile global credit data to assist immigrants in establishing their financial identities are examples of this.

4. Integration of Ecosystems

Ecosystem integration is a sophisticated approach to business process management that links an organization's primary revenue-generating activities with those of its ecosystem partners. It's the contemporary reaction to two unavoidable developments that impact companies nowadays: COVID-19 and the unstoppable move toward e-commerce. In order to facilitate seamless orchestration across critical business processes like order to cash and procure to pay, it combines modern real-time APIs with conventional batch-based EDI.

The mortgage refinancing sector is a dynamic one that moves to the beat of personal financial symphonies, regulatory harmonies, and economic melodies. In the end, borrowers have to weigh the advantages of refinancing against related expenses. For instance, a homeowner refinancing their mortgage to pay for energy-efficient improvements might benefit from a lower interest rate, but there will be up-front expenses like mortgage application fees and property appraisals. In order to optimize long-term savings, a prudent borrower will consider this.

Stay Updated

Actionable growth insights, once a week. No fluff, no spam—unsubscribe anytime.

You May Like

Comparing Liability and Collision: Knowing Your Options for Auto Insurance

06/25/2025

Becoming Eligible for a Mortgage as a New Purchaser

07/16/2025

Knowing the Differences Between Medicaid and Long-Term Care Insurance

06/20/2025

Emergency Money: When to Take into Account a Personal Loan

08/16/2025

Defending Your Property Against Theft: Advice From Renters Insurance

07/28/2025

Selecting the Ideal Health Insurance Program for Your Needs

07/18/2025

Current Trends and News on Mortgage Rates

07/24/2025

Factors in the Economy That Impact Mortgage Rates

07/14/2025

Innovations and Trends in Refinancing in the Future

08/30/2025

Getting Ready for College? Employ a student loan estimator.

07/29/2025

The Price of a Mortgage Refinancing

08/26/2025

Bankruptcy Law: A Financial Recuperation Tool

07/04/2025

A Guide to Comprehending Your Taxes and Filing Your Return

07/05/2025

Where to Apply for a Car Loan

06/15/2025

Senior Health Insurance: Medicare and Beyond

08/26/2025

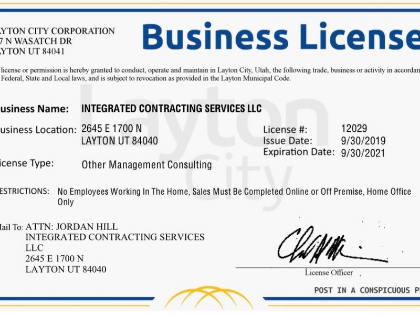

The Value of Obtaining the Appropriate Licenses and Permits for Your Business

09/02/2025

Disability Insurance: Safeguarding Your Income in the Event of an Unexpected Situation

08/03/2025

Selecting the Ideal House for Your Requirements as a First-Time Purchaser

08/13/2025

Plea Agreements and Penalties

08/03/2025

Disability Benefits for Independent Contractors

08/31/2025

Chronic Conditions and Disability Insurance: What You Should Know

07/01/2025

Taking a Personal Injury Case to Trial

08/04/2025

Recognizing Various Mortgage Types

09/01/2025

Trends and Innovations for Debt Consolidation Loans in the Future

07/26/2025

Comments

NebulaHarbor · 09/03/2025

Subtle cue to slow down.

MeridianScout · 07/07/2025

The dependency graph feels sane.