Recognizing Various Mortgage Types

Advertisement

Knowing the many mortgage options will help you choose the best one for your needs while buying a property. There is a mortgage choice that will work for you, whether your goal is to save costs with a fixed-rate mortgage or have flexibility with an adjustable-rate loan.

A construction loan facilitates home building for borrowers. Another name for this kind of mortgage is a piggyback loan.

Traditional

Unlike government-supported mortgages, conventional mortgages are backed by private lenders. This indicates that, compared to government-backed loans, they frequently adhere to stricter criteria, such as those pertaining to debt-to-income ratios and credit scores. To be eligible for a conventional loan, first-time and repeat purchasers alike usually need to have credit ratings of 620 or better, a debt-to-income ratio of no more than 43%, and enough money for a down payment. Additionally, applicants must pay PMI, which shields them from repossession in the case of a mortgage failure, as mandated by the lender.

Conventional lenders can also provide adjustable-rate mortgages, which have a fixed rate for the first period and then adjust according to an index, and non-conforming mortgages, like jumbo loans, that surpass FHFA lending regulations. Because these mortgage types carry greater risk for lenders, interest rates may be higher and qualifying requirements may be more stringent.

Obtaining customized rate quotes is crucial. Published mortgage rates are rarely accurate for everyone since they frequently assume a model homebuyer with good credit and a sizable down payment.

Federally Insured

The government backs government-insured mortgages, taking on a portion of the risk that lenders bear when you obtain a conventional loan. If you make less than a 20% down payment on a conventional loan that isn't backed by the government, you might have to pay PMI (private mortgage insurance), according to rules imposed by Fannie Mae and Freddie Mac.

Numerous mortgage products are covered by government insurance, such as USDA, VA, and FHA loans, which are backed by the U.S. Department of Agriculture, the Department of Veterans Affairs, and the Department of Veterans Affairs, respectively. These programs enable people who would not otherwise qualify for a mortgage due to financial constraints or bad credit to become homeowners by allowing for more relaxed approval conditions than traditional loans. However, because you have to pay upfront and ongoing mortgage insurance premiums, closing costs may be higher for these kinds of loans. Which solutions are appropriate for your particular circumstances can be determined with the assistance of an experienced mortgage lender.

Modifiable-Rate

Borrowers with adjustable-rate mortgages (ARMs) have a choice over the interest rate they pay on their loan. They're a great option for first-time homeowners because they can also help you save money on your monthly payments.

But before selecting an ARM, you ought to give your financial situation a lot of thought. You should be aware that not everyone is a good fit for an ARM and that your interest rates will fluctuate over time. Additionally, there are several kinds of ARMs, such as riskier options and teaser rates.

ARMs usually have a three-, five-, seven-, or ten-year initial fixed interest duration. The interest rate will continue to fluctuate after this time period ends for the duration of your loan. The ARM's name includes a second number that indicates how frequently these adjustments are made, such as "1" or "6" in the 5/6 ARM. A reference index, such as the prime rate, LIBOR, or 11th District Cost of Funds Index, determines the interest rate of an adjustable-rate mortgage (ARM).

Interest-Only

With interest-only mortgages, borrowers can pay back the principal only for a predetermined amount of time—usually five to ten years. This gives them more financial freedom in the early phases of homeownership and enables them to qualify for larger mortgage loan amounts.

Nevertheless, when the interest-only period ends, these mortgages demand a strong repayment strategy. If not, borrowers risk experiencing "payment shock," since when they start to pay down principal, their monthly payment will go up significantly.

To be sure they can continue to afford their mortgage once the interest-only period expires, borrowers should get ready by accumulating documentation attesting to their assets, income, and job. Pay stubs, bank statements, and tax returns are examples of this.

These mortgages are not suitable for everyone, even if they can be a useful tool for many. See if an interest-only mortgage is the best option for you by getting in touch with a reputable financial expert. They can help you obtain a mortgage that fits with your financial objectives by guiding you through the benefits and drawbacks of this kind of loan.

Recommended Reading:

Current Trends and News on Mortgage Rates →

Stay Updated

Actionable growth insights, once a week. No fluff, no spam—unsubscribe anytime.

You May Like

Senior Health Insurance: Medicare and Beyond

07/24/2025

Plea Agreements and Penalties

06/28/2025

Getting Ready for College? Employ a student loan estimator.

08/02/2025

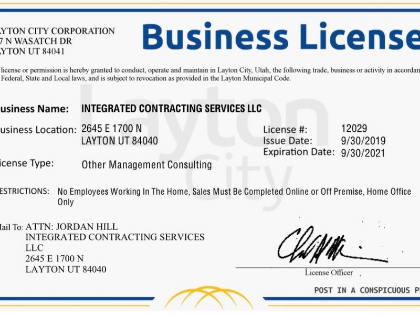

The Value of Obtaining the Appropriate Licenses and Permits for Your Business

07/10/2025

Selecting the Ideal Health Insurance Program for Your Needs

08/15/2025

Innovations and Trends in Refinancing in the Future

08/16/2025

Loan Calculators' Restrictions

06/15/2025

A Guide to Comprehending Your Taxes and Filing Your Return

07/09/2025

Auto Loans: Things to Take into Account While Financing a New or Used Vehicle

06/27/2025

Knowing the Differences Between Medicaid and Long-Term Care Insurance

06/13/2025

Comparing Liability and Collision: Knowing Your Options for Auto Insurance

08/21/2025

Taking a Personal Injury Case to Trial

08/22/2025

Becoming Eligible for a Mortgage as a New Purchaser

07/19/2025

Where to Apply for a Car Loan

06/09/2025

What You Need to Know About Renters Insurance and Subletting

08/07/2025

Disability Benefits for Independent Contractors

08/13/2025

Disability Insurance: Safeguarding Your Income in the Event of an Unexpected Situation

08/25/2025

Red Flags from Mortgage Lenders: Things to Look Out for

09/05/2025

The Price of a Mortgage Refinancing

06/11/2025

Emergency Money: When to Take into Account a Personal Loan

08/03/2025

Factors in the Economy That Impact Mortgage Rates

07/10/2025

The Advantages of Loan Refinancing at High Interest Rates

08/20/2025

Selecting the Ideal House for Your Requirements as a First-Time Purchaser

08/24/2025

Trends and Innovations for Debt Consolidation Loans in the Future

06/07/2025

Comments

AtlasRipple · 07/07/2025

Coheres with reliability goals.

VelvetAtrium · 07/20/2025

Embeds context elasticity.

MeridianScout · 07/13/2025

Leaves bias inspection space.

LatticeHarbor · 06/22/2025

Ready to apply—who’s in?

QuantumSprout · 07/31/2025

Prepares for observability layering.